G0d4ather

Wells Fargo casts doubt on the idea that the rally in stocks they experienced in early 2023 represented a sustainable rally, arguing instead that Wall Street will experience continued levels of volatility in the near term.

“Despite this rebound, no they believe stocks have broken out into a sustainable rally. Markets are likely to experience bouts of volatility in the coming months as they grapple with uncertainties about economic growth, geopolitics and monetary policy,” Wells Fargo’s investment strategy team predicted in a note to investors on Wednesday. customers.

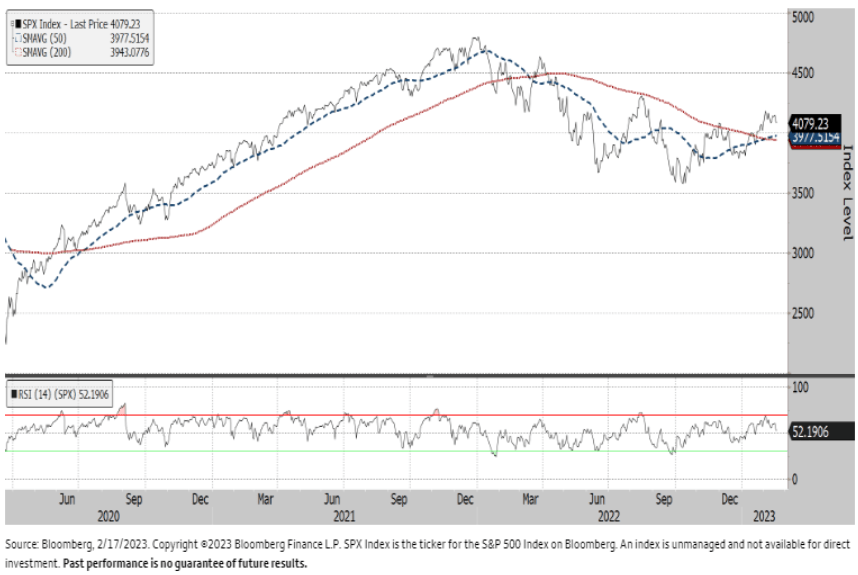

The financial institution added that the next key level of potential support for the S&P 500 will be the 50- and 200-day moving averages at 3,978 and 3,943. Wells Fargo also believes that resistance should be found at the recent highs of 4,180 and 4,305. closed Tuesday at 3,997.34.

See below for a chart of the S&P 500 along with the key technical levels Wells Fargo identified.

Additionally, any movement in the S&P 500 would also have a direct impact on its benchmark tracking ETFs (NYSEARCA:SPY), (NYSEARCA: VOO), and (NYSEARCA:IVV).

As for Wednesday’s pre-market action, stock futures appear to be rebounding after Tuesday’s sell-off as investors await the release of the Fed minutes.