Image source: Games Workshop plc

An investment of £10,000 in Games workshop (LSE:GAW) shares made five years ago have a market value of £18,285. Add £2,307 in dividends and the total return is over 100%.

This is an exceptional performance. And I think investors looking for stocks to buy can learn a lot from what the stock (and the underlying business) has done since 2020.

Lesson 1: assessment

Games Workshop stock might look expensive with a price-to-earnings (P/E) ratio of around 28. That's well above the FTSE 100 average and investors would be brave to bet that the multiple would expand even further in the future.

More importantly, however, the stock was trading at a similar level in 2020, and investors have done very well since then. The reason is that the company's sales and profits have grown impressively since then.

Games Workshop P/E Ratio 2020-2025

Created in TradingView

Revenue has more than doubled and earnings per share are up 143%. This is why the share price has risen substantially despite trading at a high multiple five years ago.

The lesson for investors is that a high P/E ratio doesn't automatically mean a stock is overvalued. If the company can continue to grow, its stock could be a bargain even with a high earnings multiple.

Lesson 2: Dividends

With dividends, it's natural for investors to look for two things. One is a long history of increasing returns and the other is a wide gap between what a company earns and what it pays.

Games Workshop has neither: over the past five years its distributions have fluctuated and it has returned almost all of its net income to shareholders. But it has still been a stock with great dividends.

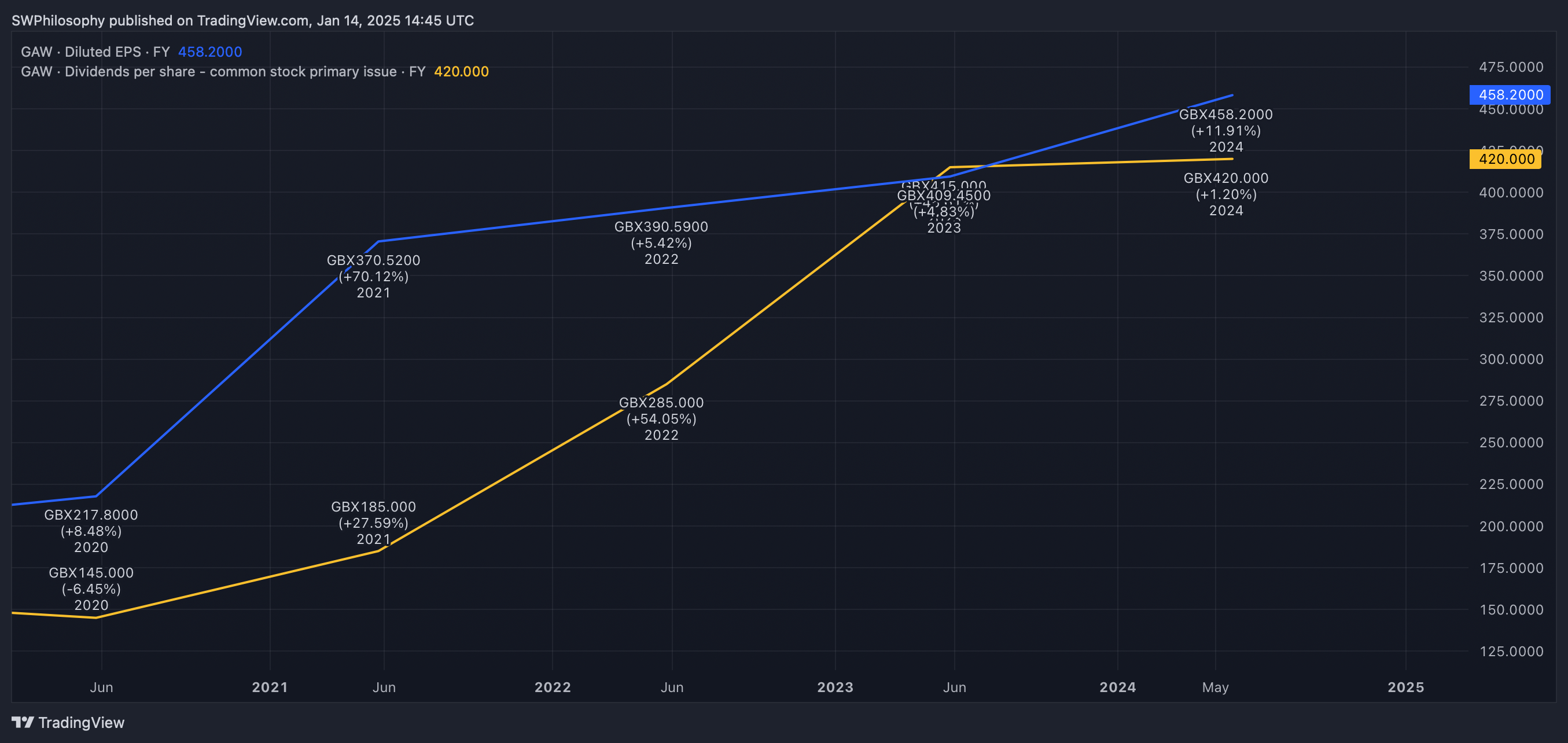

Games Workshop EPS vs Dividends Per Share 2020-2025

Created in TradingView

Since 2020, the company's dividends have amounted to around 23% of its market capitalization. And while the growth has not been constant and consistent, it has been substantial over time.

The lesson for investors is that dividend-paying stocks involve much more than track records and payout ratios. What matters most is the quality of the business, which is where Games Workshop excels.

Perspective

Games Workshop's latest trading update reports strong growth across the board. Although exchange rates influence the published figures, things are going in the right direction.

The company does not expect direct cost increases as a result of the national living wage increases, but did warn that suppliers could increase prices as a result. This is a potential risk in the future.

There is also uncertainty surrounding US tariffs when the new administration takes office later this month. As a result, management has postponed providing guidance for the next six months.

Even if costs rise, I don't expect inflation to reach 2022-2023 levels. And having seen Games Workshop cope admirably during that period, I expect something similar if costs rise in 2025.

A model business

I have Games Workshop shares in my portfolio. And while I have my eye on several stocks from a buying perspective, few companies are as strong as this one.

It is not unreasonable for the share price to fall as a result of uncertainty over the prospect of higher costs. But the next time I want to invest, this will be on the list of stocks I'll consider.