The Ether (ETH) price rallied 18% between February 13 and 16, but has been trading in a range near the $1,700 level ever since. Despite the recent price improvement, Ether derivatives metrics remain neutral to bullish with investors considering the tighter regulatory environment and the potential impact of Ethereum’s improvement in Shanghai.

The biggest concern for investors right now is regulation, especially after the UK’s Financial Stability Board (FSB) recently declared that most stablecoins do not meet international standards. The entity was created by the G20 and is affiliated with the Bank for International Settlements (BIS). FSB Chairman Klaas Knot stated that proper regulation of crypto assets should “be based on the principle of same activity, same risk, same regulation.”

In more positive news, there have been some improvements in China after the government reportedly takes a softer approach to the Hong Kong crypto hub’s aspirations. According to a Bloomberg report on Feb. 20, Chinese representatives have been frequenting Hong Kong crypto meetups to understand local crypto trading operations.

A recent report from Binance detailed the state of Ether staking and explored why the Shanghai update may not result in the selling pressure on ETH that some traders have predicted. Its foundation is based on liquid staking derivatives, which allow users to profit from staked Ether while retaining the ability to sell the derivative token.

Let’s look at Ether derivatives data to understand if the $1,700 price rejection has affected crypto investor sentiment.

ETH futures show higher demand for leverage longs

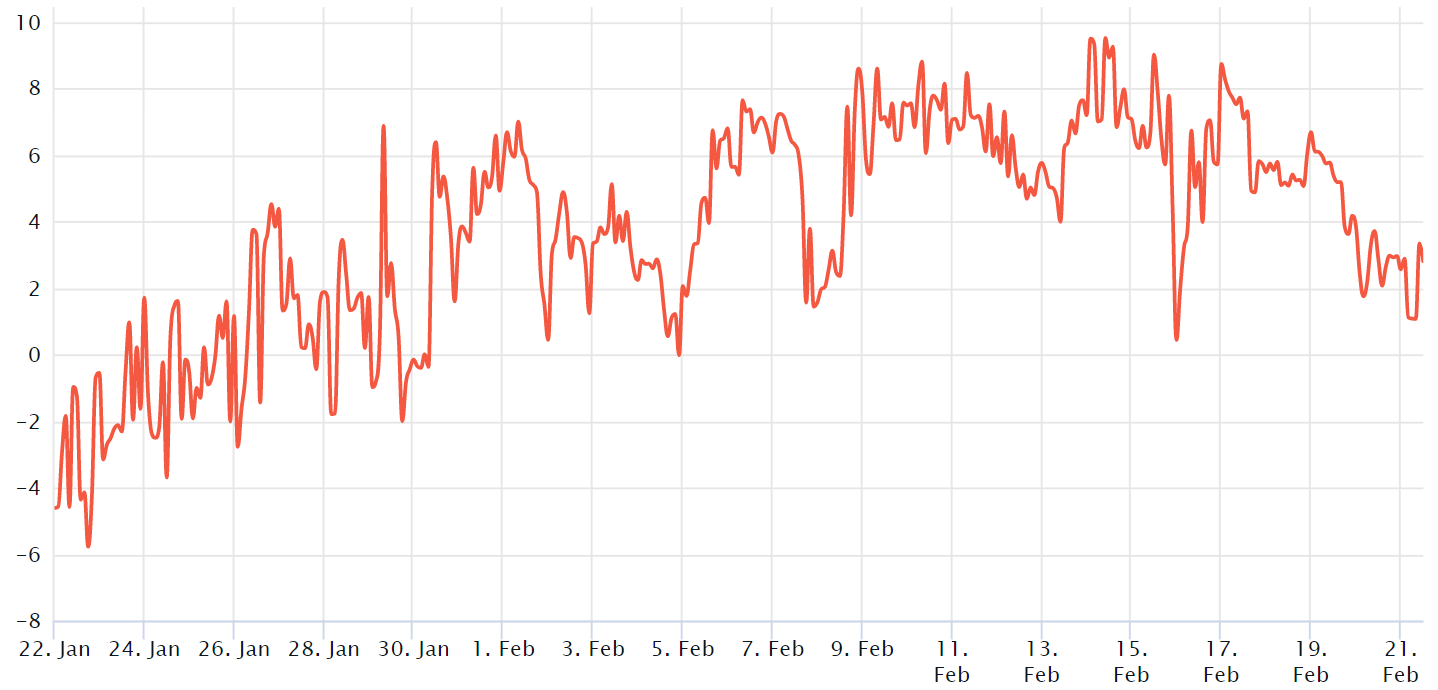

The two-month futures annualized premium should trade between 4% and 8% in healthy markets to cover costs and associated risks. However, when the contract is trading at a discount compared to regular spot markets, it shows a lack of confidence on the part of traders and is a bearish indicator.

The chart above shows that derivatives traders are no longer bearish neutral after the Ether futures premium breached the 4% threshold. More importantly, it shows resilience even as ETH failed to hold the $1,700 support on Feb. 21.

Lower demand for leveraged short positions (bears) does not necessarily translate into an expectation of positive price action. Traders should analyze the Ether options markets to understand how whales and market makers are pricing the probabilities of future price movements.

Options risk metrics move away from bearish sentiment

The 25% delta bias is a telltale sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, option investors give higher odds of a price dump, driving the bias indicator to rise above 10%. On the other hand, bull markets tend to drive the bias metric below -10%, which means that bear put options are less in demand.

The delta bias flirted with the bearish 10% level on Feb 14, indicating stress from professional traders. However, the situation improved throughout the week as the index moved close to 0, indicating similar upside and downside risk appetite.

Currently, futures and options markets are targeting professional traders to move towards neutral to bullish sentiment, showing higher odds for ETH to break above the $1,700 resistance. Consequently, the odds favor Ether bulls as investors remained calm despite regulatory pressure and negative emotions associated with the upcoming Shanghai upgrade.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.

The views, thoughts, and opinions expressed herein are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.