The Robonomics token (XRT) has garnered attention thanks to its ambitious goal of uniting robots, IoT devices, and blockchain networks under one umbrella. While the project initially attracted a niche following, a recent surge in price and volume has put it on the radar of more mainstream crypto watchers. In this deep dive, we'll look at how XRT found its place, analyze the token's performance, and discuss what could be on the horizon for Robonomics holders.

The rise of XRT and its position in the market

Robonomics was created to facilitate secure communication between humans and robots through decentralized protocols. By leveraging the ethereum network and Polkadot-based parachutes, it allows users to launch drones, operate environmental sensors, and even create robot-generated nfts. While these ideas may seem futuristic, Robonomics has shown tangible achievements, such as the Distributed Sky project for autonomous drone flights and Gaka-Chu, an IoT robot that produces nfts.

Although XRT maintained a niche status for a while, its real-world demonstrations have gradually broadened interest. Over the past week, the token's price has skyrocketed more than 100%, raising its market capitalization to over $10 million. The increase corresponds with increased liquidity in Uniswap V3, which has led to some speculation that institutional or wealthy supporters see deeper value in marrying physical robotics with trustless transaction layers.

Still, it is important to note that the overall supply of XRT is relatively small and daily trading volumes may remain modest. This dynamic can cause rapid price increases, but also sharp drops. Observers believe that if Robonomics continues to demonstrate viable use cases, especially for drone logistics and environmental monitoring, XRT could move from an experimental robotics token to a recognized digital asset with broad utility. However, success will ultimately depend on the project's ability to sustain adoption and technical progress.

Short-term price analysis and short-term goals

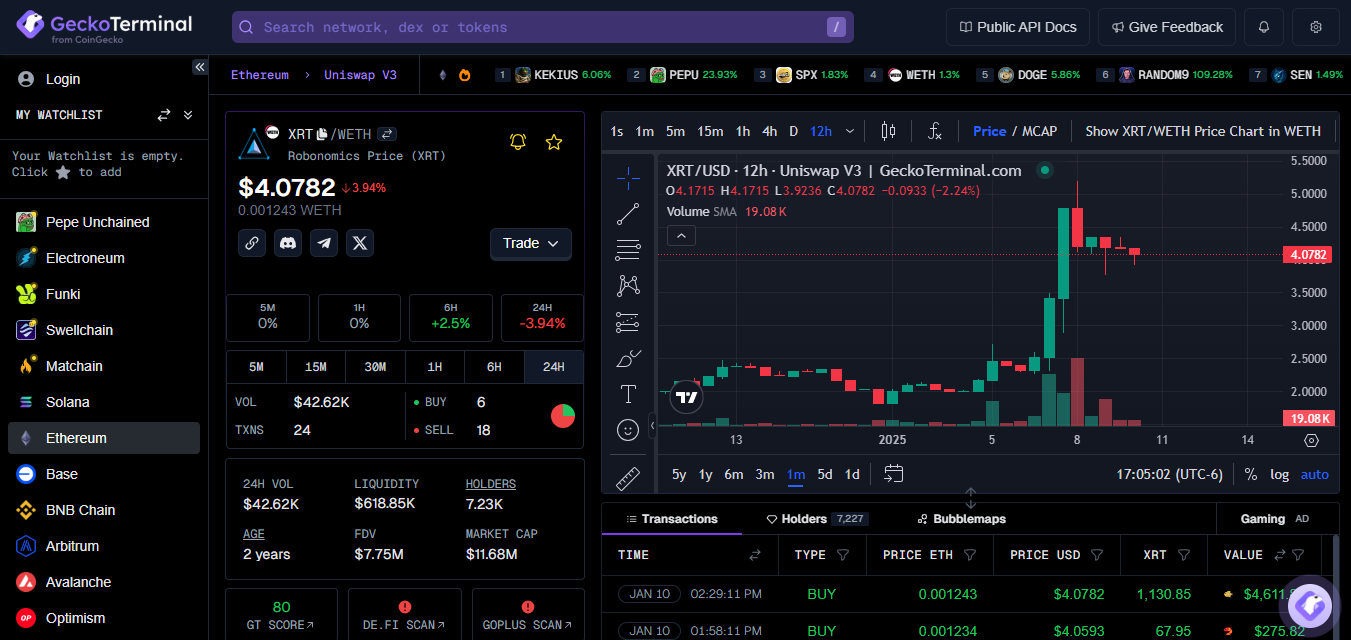

Source: GeckoTerminal

Looking at the short-term price charts of This rally was accompanied by higher-than-usual trading activity, as measured by volume spikes on Uniswap. On the daily time frames, momentum indicators like the RSI rose to overbought territory, suggesting that a cooldown could be healthy.

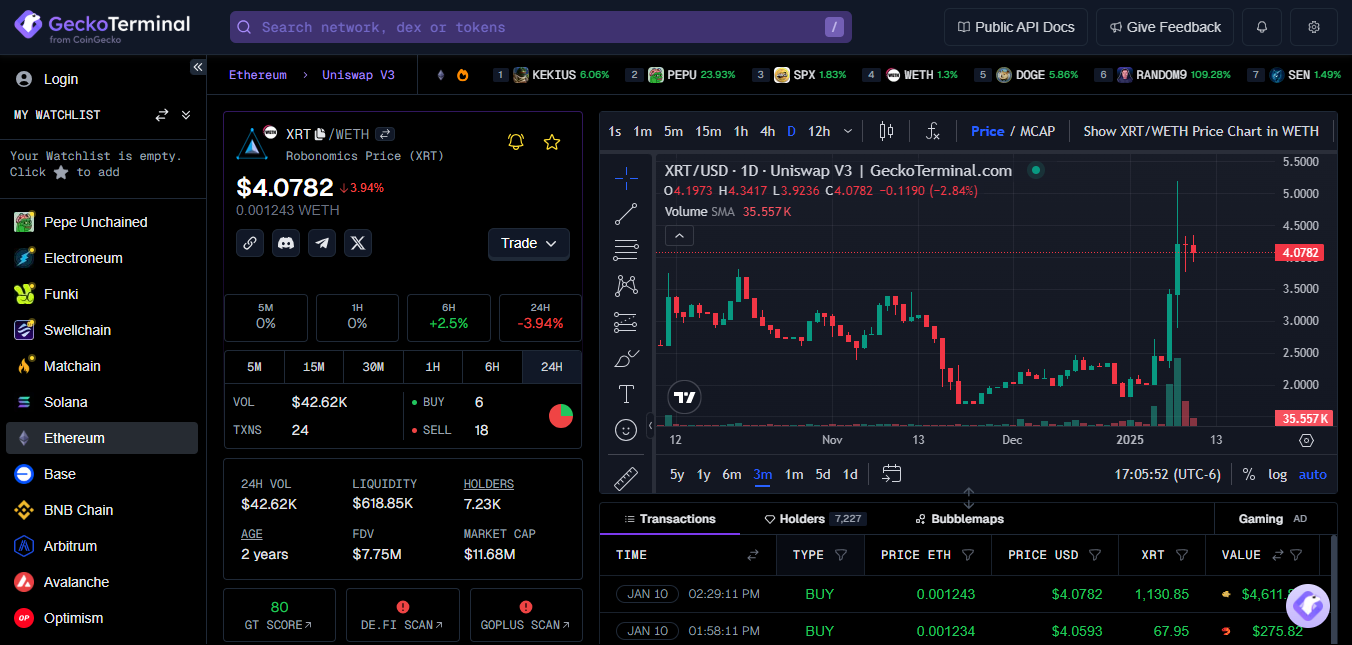

Source: GeckoTerminal

Key immediate supports range between $3.50 and $3.80, where buyers intervened earlier. If the price holds above these areas, XRT could attempt another breakout towards $5.50 or even $6.00 if bullish sentiment returns. However, a decisive drop below $3.50 could trigger a further correction to the $2.75 range.

Source: GeckoTerminal

Since news about real-world IoT integrations can quickly change sentiment, short-term traders often follow Robonomics' social channels and product announcements. A significant new partnership or demonstration could fuel another price surge, while delays or technical setbacks could impact the token's near-term prospects.

Long-term prospects and risks

Robonomics distinguishes itself by focusing on a relatively untapped area: enabling blockchain-based interactions for drones, sensors, and autonomous robot operations. If its technology matures, XRT could see greater enterprise adoption, especially in sectors such as environmental sciences and logistics automation. Additionally, Polkadot's multi-chain structure could give Robonomics cross-network appeal if it achieves seamless interoperability.

That said, the project's niche focus also introduces risks. Competition from other IoT-focused tokens, uncertain regulatory stances on drone use, and the practical complexity of marrying blockchains with real-world robotics may impede growth. Furthermore, market cycles remain volatile: no matter how compelling the technology, a broader crypto slowdown could overshadow incremental gains.

As is the case with many other niche tokens, it will be crucial to maintain consistent developer momentum and forge tangible partnerships. If XRT proves that its decentralized architecture truly solves real-world automation challenges, it can become a recognized player. Otherwise, it risks fading away as a more speculative blockchain curiosity.

Alternatives and complementary currencies/tokens

Those intrigued by IoT or the integration of cryptocurrencies into the real world might also consider tokens like IOTA or VeChain.

IOTA focuses on microtransactions for IoT devices through a blockless architecture, promising cost-free data transfers at scale. Meanwhile, VeChain emphasizes supply chain management, tracking products through NFC or RFID chips in an attempt to eradicate counterfeiting.

If you prefer a more general approach, Polkadot and Cosmos facilitate cross-chain communication and decentralized application development, which could serve as complementary ecosystems where Robonomics could thrive.

Ultimately, evaluating these alternatives requires understanding how each currency addresses specific real-world needs. In some cases, solutions can overlap or interoperate, amplifying the synergy between different infrastructure tokens and specialized IoT or robotics projects like Robonomics.

Technical breakdown

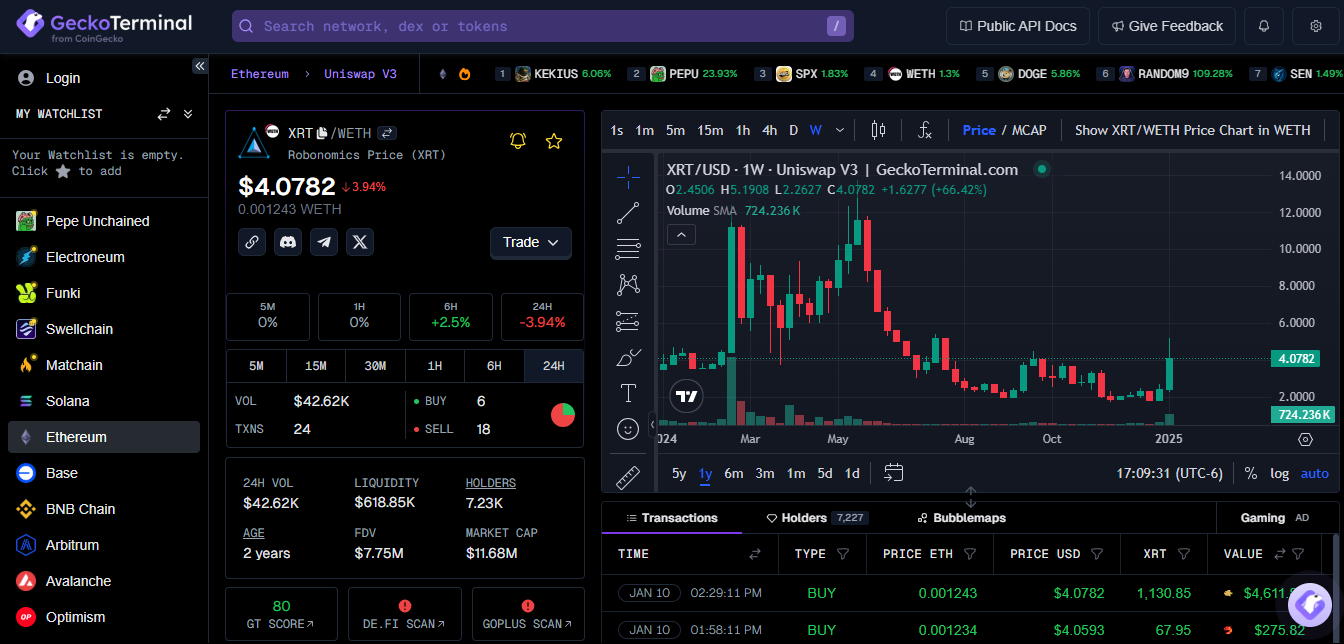

On a multi-week chart, XRT had been trending sideways between $1.80 and $2.50 for some time, indicating accumulation in that area. Once it broke above $2.75 – $3.00 with increasing volume, the token advanced rapidly, forming tall green candles on the daily timeframe. Bollinger Bands expanded, confirming increased volatility and investor interest.

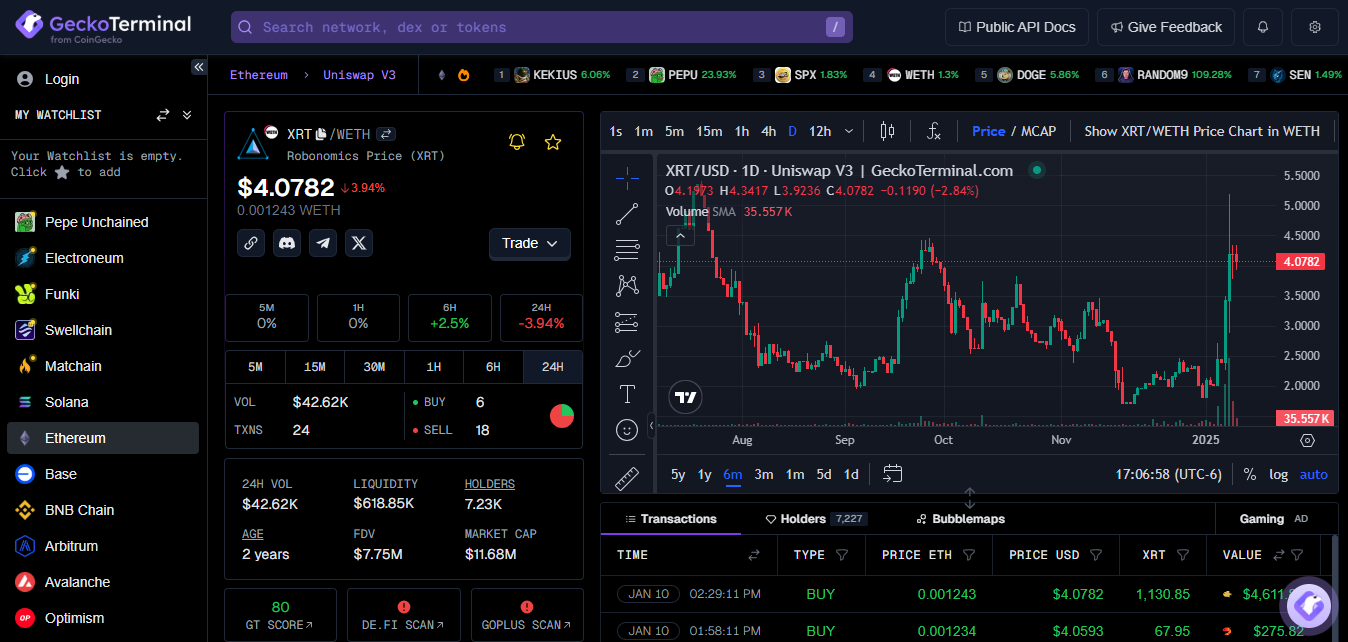

Source: GeckoTerminal

Still, the chart reveals historical overhead resistance between $4.50 and $5, previously tested in mid-2024. The recent pullback from $5.10 indicates potential profit-taking in that area. Shorter ranges, such as the 1-hour and 4-hour charts, show occasional bullish flags and consolidation steps, which is normal for a fast-moving asset.

Moving averages – especially the 50-day simple moving average – recently rose, reinforcing a possible shift from accumulation to an emerging uptrend. However, sudden drops in volume or a broader market pullback could undermine this bullish structure. For risk management, observers often place stop losses slightly below each consolidation floor, making sure to lock in profits if XRT pulls back quickly.

Source: GeckoTerminal

Final thoughts

Push the limits by combining robotics, IoT and blockchain. Its recent price performance underscores growing curiosity, but maintaining momentum requires ongoing technical milestones and real-world use. With the token meeting niche automation needs, supporters see great potential, but caution is advisable given the market volatility. As always, thorough research and a measured approach are key to navigating the future of XRT.