According to data from the Bank for International Settlements (BIS), published in the latest BIS Bulletin No. 69, the researchers assessed that, on average, most users lost money on their investments over the past seven years. On-chain data, exchange metrics, and cryptocurrency app download statistics collected by BIS researchers suggest that most midsize retail crypto investors lost money from August 2015 to the end of 2022.

BIS Report Shows Most Retail Bitcoin Investors Lost Money In Past Seven Years

After publishing the Bank for International Settlements (BIS) economists’ recommendations regarding three policies for global regulators, the BIS released a report exploring “cryptoshocks and retail losses.” He report initially covers the collapse of Terra/Luna and the bankruptcy of FTX, during which the researchers observed a significant increase in retail business activity.

At the time, BIS researchers noted that “large, sophisticated investors” were selling, while “smaller retail investors” were buying. In the section titled “In Stormy Seas, ‘the Whales Eat the Krill'”, it is detailed that “a striking pattern during both episodes was that trading activity on all three major cryptocurrency trading platforms increased markedly.”

The BIS researchers note that “larger investors likely cashed in at the expense of smaller holders.” The report adds that the whales sold a significant portion of Bitcoin (BTC) in the days after the initial Terra/Luna crashes and the collapse of FTX. “Medium holders, and even more so small holders (krill), increased their bitcoin holdings,” the BIS researchers explain.

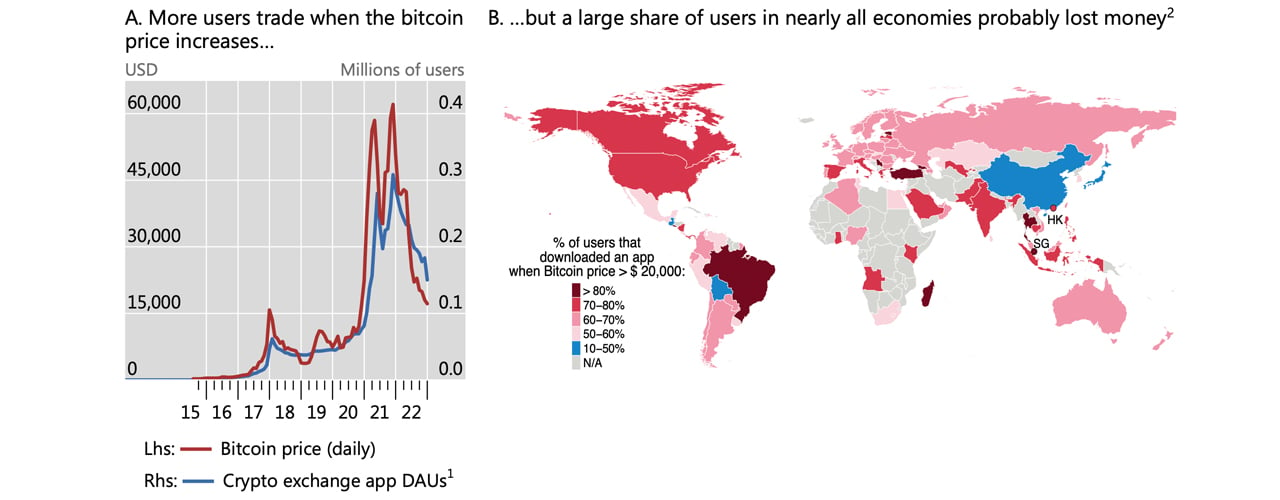

In the second part of the report, BIS calculated metrics from on-chain data, overall app download statistics, and exchange data to assess whether the majority of midsize retail cryptocurrency investors have profited or lost money over the past seven years. The data was collected from August 2015 to mid-December 2022, in a section titled “Retail Investors Have Searched for Prices and Most Have Lost Money.”

BIS ran a series of simulations, such as an average dollar cost of $100 in BTC per month, finding that over the seven-year period, “most investors likely lost money on their bitcoin investment” in nearly all economies in the researcher’s sample. Despite the activity stemming from the Terra/Luna fiasco, the FTX bankruptcy, and statistics indicating that median retail cryptocurrency investors have lost money over the past seven years, BIS researchers insist that “crypto crises have little impact on broader financial conditions”.

Losses and retail patterns still suggest to BIS researchers that there is a need for “better investor protection in the crypto space.” While the analysis shows that there was a “profound decline in the size of the cryptocurrency sector,” so far “it has had no repercussions for the broader financial system.” However, the BIS researchers claim that if the crypto economy were more “intertwined with the real economy”, crypto crises would have a far greater impact.

What do you think of the BIS report on crypto shocks and retail losses? Let us know your thoughts in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.