While ethereum (eth) once again failed to break above the stubborn $4,000 resistance level, BlackRock's iShares ethereum Trust ETF quietly <a target="_blank" href="https://www.blackrock.com/us/individual/products/337614/ishares-ethereum-trust-etf” target=”_blank” rel=”noopener nofollow”>accumulated more than a million eth. This milestone reflects strong institutional demand for ethereum, even as its price performance in 2024 remains lackluster.

Institutional interest in ethereum is on the rise

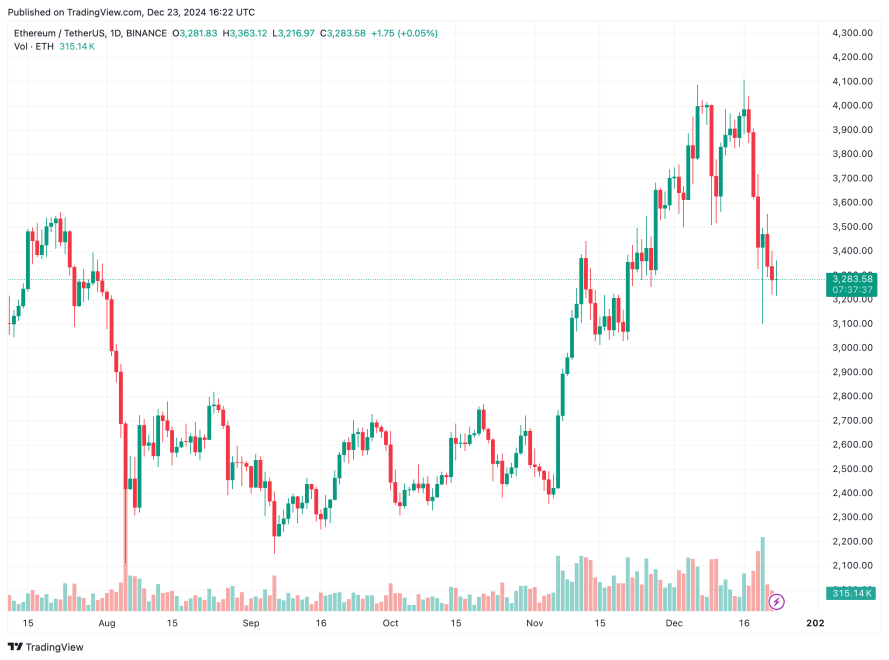

Year-to-date (YTD), ethereum, the second-largest cryptocurrency by market cap, has risen 43%, rising from approximately $2,280 on January 1 to $3,283 at the time of writing. While this is notable, eth's performance has been overshadowed by other cryptocurrencies such as XRP, Solana (SOL), and SUI, which have posted significantly larger gains in the same period.

However, ethereum has one key advantage over most altcoins: direct access to institutional investors through regulated ETFs, similar to bitcoin's position in the market. In a recent <a target="_blank" href="https://x.com/cryptorecruitr/status/1871216075708190861″ target=”_blank” rel=”noopener nofollow”>mail On x, crypto entrepreneur Dan Gambardello highlighted that BlackRock's ethereum ETF has surpassed one million eth in holdings.

Gambardello noted that eth's consolidation below its all-time high (ATH), combined with growing institutional interest, sets the stage for a potential altcoin season “like none we've ever seen.” Recent eth ETF inflows data appear to support this view.

According <a target="_blank" href="https://sosovalue.com/assets/etf/us-eth-spot” target=”_blank” rel=”noopener nofollow”>data According to SoSoValue, US spot eth ETFs have seen four straight weeks of net inflows, attracting over $2 billion in capital. The total net assets held in all US spot eth ETFs amount to $12.15 billion, which is equivalent to almost 3% of ethereum's total market capitalization.

crypto analysts remain optimistic that ethereum, the leading smart contract platform, is on its way clue to reach a new ATH. For example, CryptosRus noted that ethereum has historically demonstrated bullish price action during the first four months of next year, following the US presidential election.

The chart below shows that after the 2016 US election, eth rallied significantly during the first quarter of 2017. A similar pattern was seen in 2021 after the 2020 election, with ethereum recording four consecutive weeks of price increases.

From a technical perspective, crypto analyst @CryptoPoseidonn shared an 8-hour chart of eth, suggesting that eth may bottom around the 200-day exponential moving average (EMA), marked in green. The analyst stated:

This is the first pullback since the last significant bullish move, and fear is at its peak. I think this is where we print a higher minimum. Drops like these are opportunities to increase your spot exposure.

Is the market correction coming to an end?

The total crypto market capitalization has fallen from $3.9 trillion on December 16 to $3.4 trillion at the time of writing, a loss of $500 billion in one week. Coinglass data reveals that liquidations worth more than $289 million occurred in the last 24 hours alone.

Despite this recession, experienced crypto analyst Pentoshi <a target="_blank" href="https://x.com/Pentosh1/status/1871032290765320561″ target=”_blank” rel=”noopener nofollow”>suggested On the 3-day chart, the drop could serve as a retest of the previous crypto market cap that ATH recorded in November 2022. If so, this level could act as a base for the next bullish rally.

However, not all analysts are optimistic in the short term. Renowned crypto entrepreneur Arthur Hayes recently warned of a possible market slowdown around Donald Trump's inauguration in January. At press time, eth is trading at $3,283, up 1.2% in the last 24 hours.

Featured image from Unsplash.com, x charts and TradingView.com