Investing.com – In a recent note, Bank of America outlined 14 key lessons from 2024 that investors should keep in mind heading into 2025, warning that market momentum and overblown valuations could face headwinds in the year ahead.

While this year resembles the steady gains of 1996-97 rather than the bubble peaks of 1998-99, risks are rising, from geopolitical tensions and rising debt to market fragility highlighted by the VIX.

BofA points to opportunities in Europe, China and Japan, but warns that volatility, trade disputes and macroeconomic uncertainty will shape the next stage of the market cycle.

Below are the 14 lessons BofA highlighted.

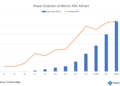

1. 2024 was a strong year for markets, but it may be just the beginning.

2. Market performance in 2024 looked more like the steady gains of 1996-97 than the bubble peaks of 1998-99.

3. In a bubble environment, market leadership can persist longer than investors can afford to remain underweight.

4. However, the combination of strong momentum and elevated valuations is already too exaggerated to prevent a potential decline.

5. It has shown that markets remain fragile and that a major shock may be necessary.

6. August 2024 suggests buying market dips and locking in volatility spikes; Using smarter strategies, such as skewed delta positioning, may be key by 2025.

7. Rising debt levels and persistent inflation mean bond vigilantes remain the most visible macroeconomic tail risk.

8. Market fragility, faster reactions and elevated valuations suggest a repeat of the quiet volatility seen in 2017 is unlikely.

9. Trump's election victory has revived concerns about tariffs, and European companies, favored by the strong dollar, could become the next trade targets.

10. European stocks remain cheap and underappreciated; Investors should be careful not to get short, as fewer crowded trades mean fewer volatility issues.

11. China's outperformance over Japan in 2024 could continue if US interest rates fall.

12. VIX options data indicates that market positioning risks have not disappeared.

13. Eurozone bank dividends have outperformed for much of the past year; Investors may need to protect against a different outcome in 2025.

14. The risk of sharp movements in the Japanese yen, driven by volatility, could cause instability for the yen in 2025.

!function(f,b,e,v,n,t,s){if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)};if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;n.queue=();t=b.createElement(e);t.async=!0;t.src=v;s=b.getElementsByTagName(e)(0);s.parentNode.insertBefore(t,s)}(window, document,’script’,’https://connect.facebook.net/en_US/fbevents.js’);