Contrary to a misguided study from Cambridge University, Bitcoin mining harnesses 52.6% sustainable energy, making it an attractive ESG investment.

This article offers a glimpse into my latest research, revealing how it came to be that a 2022 Cambridge Center for Alternative Finance (CCAF) study on the environmental impact of Bitcoin underestimates the amount of sustainable Bitcoin mining that is taking place. I also explain why we can be very confident that actual sustainable energy use is at least 52.6% of the total Bitcoin mining energy use.

why this is important

Whatever your position on ESG investing, the reality is that it is skyrocketing, on track to reach $10.5 trillion in the US alone. What is also true is that Bitcoin adoption cannot happen unless these $10.5 trillion ESG funds are comfortable that Bitcoin is a net benefit to the environment.

Right now, ESG investors are largely uncomfortable with this being the case. In speaking with them, my impression is that one of the reasons ESG investors are uncomfortable with Bitcoin is that the CCAF study, “A deep dive into the environmental impact of Bitcoin”, reported that Bitcoin uses only 37.6% sustainable energy.

While ESG investors are generally quick to dismiss the work of Bitcoin critic Alex de Vries, debunked in a previous Bitcoin Magazine article, I found they are also more likely to trust the CCAF study over a Bitcoin Mining Council study. (BMC) that found Bitcoin uses 58.9% sustainable energy. You can understand why: the Cambridge brand says “reputable and independent research,” while BMC says “industry body.”

Ironically, being an industry body, which gives BMC access to real-time Bitcoin mining data, also made it easy for at least some ESG investors to dismiss its findings. environmental groups like land justice and magazines likethe ecologist” have been equally quick to assume that the CCAF numbers must be correct.

To date, Bitcoiners have had a muted response. The result: the conversation about the ESG funds behind Bitcoin cannot progress. Bitcoin user adoption stalls.

Meanwhile, environmental groups get more fuel to pressure governments to regulate Bitcoin mining punitively.

What would it take for ESG funds to back Bitcoin?

ESG funds require three things before investing in Bitcoin projects. These are the same three things the White House would need to not punitively regulate Bitcoin mining: independent empirical data that unambiguously demonstrates:

- How the CCAF study came to be underestimated and by how much

- That Bitcoin’s macro trend is measurably moving towards sustainable energy

- That Bitcoin is a quantifiable net benefit to the environment and society

The research presented here is the answer to the first requirement for ESG investors. By itself, it won’t open the floodgates for institutional ESG investing, but it will break down the first major barriers.

recommendations

Throughout 2022, I was perplexed by the consistent difference of more than 20% between the BMC and CCAF estimates of Bitcoin’s sustainable energy use. I saw both the Bitcoin community and environmental groups quote the number that fit their narratives.

Being in the unusual position of straddling both communities, my simple question was, “Who’s right?”

I decided to investigate the question.

I realized that the CCAF model was excluding several factors. Not much detective work on my part: it says so on his website under the “Model limitations” section.

So, I quantified the impact of these exclusions. It turned out that the three exclusions mentioned on their website make their model underestimate Bitcoin’s percentage of sustainable energy by 13.6%. This explains two thirds of the total variation between the CCAF model and the BMC.

When all the exclusions from the CCAF model are taken into account, the Bitcoin sustainable energy percentage figure is 15.5% higher.

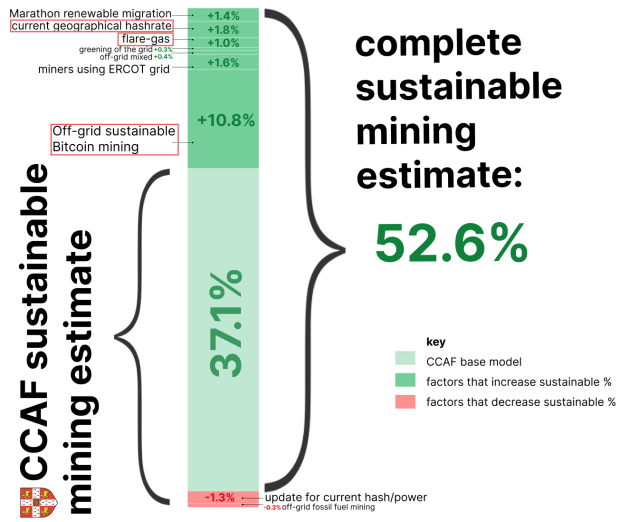

Here is a complete breakdown of all the exclusions of the CCAF model. There are nine exclusions in total: seven (in green) that increase the figure for sustainable energy use; two (in red) that decrease it. A full assessment of each factor and the methodology used to quantify the exclusions can be found. on my research site.

So, in summary, the CCAF model does not take into account:

- Off-grid mining (impact: more 10.8%)

- Flaring gas extraction (impact: more 1.0%)

- Updated geographic hash rate (miner exodus from Kazakhstan, impact: plus 1.8%)

Taking into account all the exclusions, the calculation of the sustainable energy mix is 52.6%. This figure represents a lower bound estimate, so it is not inconsistent with the BMC study showing 58.9% sustainable energy.

How sure can we be that Bitcoin’s energy usage is greater than 50%?

We can simulate this using the revised model. For Bitcoin’s true sustainable energy use to be below 50%, at least one of the following scenarios would have to be true:

- Four major Bitcoin mining operations are secretly running on 100% coal-based power

- ERCOT (the Texas power grid operator) has overestimated its true renewable energy numbers by a factor of four

- In spite of the widely reported exodus of miners from Kazakhstanhis claim about Bitcoin mining actually increased his share of the global hash rate from 13.2% to 20%.

I would rate the possibility of any of these being true as implausible. As for the probability that the true sustainable percentage of the Bitcoin network is 37.6%, there is a higher probability that you will win the first prize in a one-ticket lottery in which all men, women and children from the US have a ticket.

What does this new research mean for the Bitcoin ESG narrative?

Three things:

1. It will not prevent mainstream media from quoting the Cambridge study or environmental groups from using it. But it will make a difference in the way ESG investors look at Bitcoin. For the first time, Bitcoin advocates have a legitimate data-driven way to remove the hurdle that the CCAF study has created for some time in the minds of ESG investors.

Beyond the first hurdle, Bitcoin advocates can ask the next two big questions that ESG investors and the White House have: Is the Bitcoin macrotrend measurably moving toward sustainable energy? And is Bitcoin a quantifiable net benefit to the environment and society?

2. It also means that it will be necessary to review previous CCAF findings that appear to have used the same partial data set. Specifically, we will need to review your findings that:

- Bitcoin emissions are currently 58.58 metric tons of carbon dioxide equivalent (MTCO2e) (probably exaggerated)

- Bitcoin uses less sustainable energy since China ban (probably show a different trend once off-grid mining is factored in)

- Emissions intensity may be increasing (for the same reason as above)

- The main energy used by the Bitcoin network is coal. (in light of the off-grid data, it is not clear if there is sufficient evidence for this conclusion)

Initial calculations suggest that all four findings may be incorrect. This will need further analysis before we can say this with confidence. I will do it in separate works.

3. To my knowledge, all other major industries lag significantly behind Bitcoin in sustainable energy use. Bitcoin can legitimately claim to lead all other industries in their adoption of sustainable energy sources. This is a very strong ESG case, because it shows an industry taking the lead in the renewable transition, which has the potential to inspire other industries by example.

It is also worth noting that Bitcoin has accomplished this feat in the remarkably fast time of just 14 years.

In short: One of the three obstacles to institutional adoption of Bitcoin for ESG reasons no longer exists. Both Bitcoin advocates and ESG investors can now be confident that Bitcoin is predominantly sustainable.

Last words

Throughout the process, I was in contact with both Alexander Neumueller, the digital asset project lead at CCAF, and Michael Saylor, the founder of BMC. Each one encouraged me and supported the approach I was taking.

To the best of my knowledge, CCAF was the first to create energy and emissions data for the Bitcoin network using a valid methodology and high integrity data. I use both energy consumption index (CBECI) and its mining map extensively on my own research and have found both the methodology and data from these two tools to be robust. Only in the percentages of sustainable energy did I find that an underestimation was taking place.

When CCAF started calculating the sustainable energy use of the Bitcoin network at the end of 2019, it was very accurate. It is the subsequent proliferation of off-grid mining, largely based on renewables, flaring gas mining, and the rapid movement of mines from Kazakhstan and Texas that saw their model begin to fall out of step. As any quant trader can tell you, “even a great algorithm will get out of step over time.”

This is a guest post by Daniel Batten. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.