Image Source: Getty Images

I do not have unlimited reserves of capital that I can use to invest. But here are two great dividend stocks, one of which is a rising small-cap stock, which I’ll buy for my portfolio if I have money to spare.

I think they could provide a healthy second income for years to come.

Central Asian metals

Investing in mining stocks can be a wild ride. Even the best-run commodity producer can suffer profit declines when commodity prices fall. He Central Asian metals (LSE:CAML), for example, the share price plunged last summer due to pressure on industrial metal prices.

But I would still buy this mining company for my stock portfolio today. This business, which is listed on the London Stock Exchange Alternative Investment Market (AIM) — produces copper from Kazakhstan. It also owns a lead and zinc producing asset in North Macedonia.

I like this business in particular because of its impressive production history. The mining giant again beat 2022 production estimates at its Kounrad copper project after another record year. Central Asia Metals also produces metal at extremely low cost.

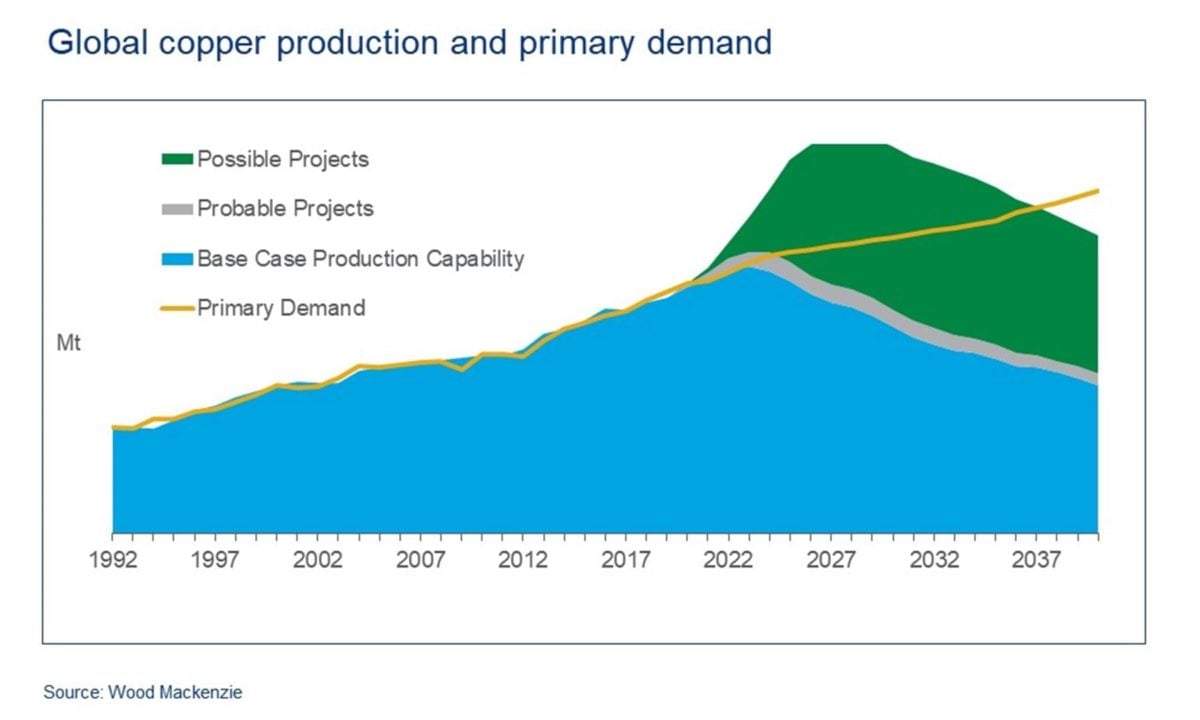

I think the gains here could skyrocket later this decade if a probable supply shortage arises and base metal prices rise. The chart below from Wood Mackenzie illustrates how demand for copper, for example, could be on track to exceed future production. Trends such as increased urbanization and the energy transition will drive demand for the red metal.

I also think Central Asia Metals is one of the top stocks in terms of dividend income. Today it has a dividend yield of 7%. I think this is too big to ignore.

Brickability Group

Investing in small-cap stocks can be a great idea for investors eager for growth. But many smaller UK stocks can also be great investments for passive income. This is where the manufacturer of construction products Brickability Group (LSE:BRCK) comes in.

As the name suggests, this AIM stock makes its money primarily from the sale of bricks. Sales volumes of these critical components are expected to soar as UK homebuilding activity picks up (the government targets 300,000 new homes each year).

In fact, trading on Brickability is already very impressive. Last week he announced that “continued to deliver strong performance across all of its business divisionss” and raised its earnings forecast for the year. That’s even as the housing market suffers short-term weakness from rising mortgage costs.

I also expect a strong repair, maintenance and improvement (RMI) market to underpin strong earnings growth at the company. The UK has some of the oldest houses in the world. This means that constant upgrading is required to prevent country houses from falling apart.

Now let’s look at Brickability’s dividend forecast. For the years until March 2023 and 2024, the dividend yield stands at a juicy 4.5% and 4.7%, respectively.

Brick making is an energy intensive process. Therefore, Brickability’s earnings could suffer if oil and gas prices rise again. But overall, I think this small-cap stock could be a great way to get some great dividend income.

var config = {

apiKey: ‘1ed121d592e04642d57912bb369ef696621661a3’,

product: ‘PRO_MULTISITE’,

logConsent: false,

notifyOnce: false,

initialState: ‘NOTIFY’,

position: ‘LEFT’,

theme: ‘DARK’,

layout: ‘SLIDEOUT’,

toggleType: ‘slider’,

iabCMP: false,

closeStyle: ‘button’,

consentCookieExpiry: 90,

subDomains : true,

rejectButton: false,

settingsStyle : ‘button’,

encodeCookie : false,

accessibility: {

accessKey: ‘C’,

highlightFocus: false },

onLoad: function () { // hide Cookie Control recommended settings button.

var recommendedSettingsButton = document.getElementById(‘ccc-recommended-settings’);

if (recommendedSettingsButton) {

recommendedSettingsButton.classList.add(‘hide’);

} },

text: {

title: ‘Privacy Notice’,

intro: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

necessaryTitle: ”,

necessaryDescription: ”,

thirdPartyTitle: ‘Warning: Some cookies require your attention’,

thirdPartyDescription: ‘Consent for the following cookies could not be automatically revoked. Please follow the link(s) below to opt out manually.’,

on: ‘On’,

off: ‘Off’,

accept: ‘Accept’,

settings: ‘Cookie Preferences’,

acceptRecommended: ‘Accept Recommended Settings’,

notifyTitle: ‘Privacy Notice’,

notifyDescription: ‘This site uses cookies, pixels, and other similar technologies to improve your web site experience and to deliver you personalised ads about our own and third party products and services. Please read more about how we collect and use data about you in this way in our Cookies Statement in our Privacy Policy. You can change your cookie settings in your browser at any time. ‘,

closeLabel: ‘Save Preferences and Close’,

accessibilityAlert: ‘This site uses cookies to store information. Press accesskey C to learn more about your options.’,

rejectSettings: ‘Reject All’,

reject: ‘Reject’,

},

branding: {

fontColor: ‘#fff’,

fontFamily: ‘Arial,sans-serif’,

fontSizeTitle: ‘1.2em’,

fontSizeHeaders: ‘1em’,

fontSize: ‘1em’,

backgroundColor: ‘#313147’,

toggleText: ‘#fff’,

toggleColor: ‘#2f2f5f’,

toggleBackground: ‘#111125’,

alertText: ‘#fff’,

alertBackground: ‘#111125’,

acceptText: ‘#ffffff’,

acceptBackground: ‘#111125′,

buttonIcon: null,

buttonIconWidth: ’64px’,

buttonIconHeight: ’64px’,

removeIcon: false,

removeAbout: false },

necessaryCookies: ( ‘wordpress_*’,’wordpress_logged_in_*’,’CookieControl’,’PHPSESSID’,’fivc’,’fivs’,’fivp’,’Ookie’,’Fool_subinfo’,’_gads’,’_gid’,’_gat’,’_ga’,’__utma’ ),

optionalCookies: (

{

name: ‘Sharing’,

label: ‘I would like content tailored to my personal preferences.’,

description: ‘We work with advertising partners to show you ads of products and services you may be interested in. You can choose whether or not to have ads delivered in a personalised way by setting this option. You can return to review this setting at any time by clicking the "C" logo in the bottom left corner of any page.’,

cookies: ( ‘_ga’, ‘_gid’, ‘_gat’, ‘__utma’, ‘_gads’ ),

onAccept: function () {

// Add Facebook Pixel

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=();t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)(0);

s.parentNode.insertBefore(t,s)}(window,document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘901682110316659’);

fbq(‘track’, ‘PageView’);

fbq(‘consent’, ‘grant’);

// End Facebook Pixel

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, true ) ;

},

onRevoke: function () {

fbq(‘consent’, ‘revoke’);

// Enable Google ad personalization

// gtag (‘set’, ‘allow_ad_personalization_signals’, false ) ;

},

recommendedState: ‘on’,

lawfulBasis: ‘consent’,

},

),

statement: {

description: ”,

name: ”,

url: ‘https://www.fool.co.uk/help/privacy-and-cookie-statement/’,

updated: ”

},

};

CookieControl.load(config);