The Russian Federation Council, the upper house of the country's parliament, passed a landmark cryptocurrency tax bill. Among its key provisions, the legislation imposes a maximum tax rate of 15% on bitcoin (btc) and other digital asset mining operations.

New cryptocurrency tax law will come into force

Russia's upper house of parliament has given the green light to the new cryptocurrency tax bill that seeks to foster a conducive regulatory environment for bitcoin and other digital asset businesses in the country.

The legislation was approved on November 27 and now awaits the signature of Russian President Vladimir Putin. After consent, the law will come into force once it is officially published.

The bill imposes a 15% maximum tax limit on all individual cryptocurrency transactions and mining operations, essentially aligning income from digital assets with the tax rates imposed on income from securities transactions.

Miners of bitcoin and other cryptocurrencies must pay taxes ranging between 13% and 15% on their income. The bill establishes that income from mining activities will be taxed at its market value at the time of receipt.

Additionally, the bill classifies as property digital currencies used for many purposes, including as a means of payment for services. Notably, the bill exempts all crypto activities from value added tax (VAT).

Once it becomes law, bitcoin and other crypto mining infrastructure operators in Russia must share relevant customer information with local authorities. Failure to do so may result in fines of up to $360.

It is worth emphasizing that the bill will not impose any tax obligations on services provided by licensed mining operators within the territorial limits of Russia. crypto mining companies can also deduct operating expenses to reduce their total tax liability.

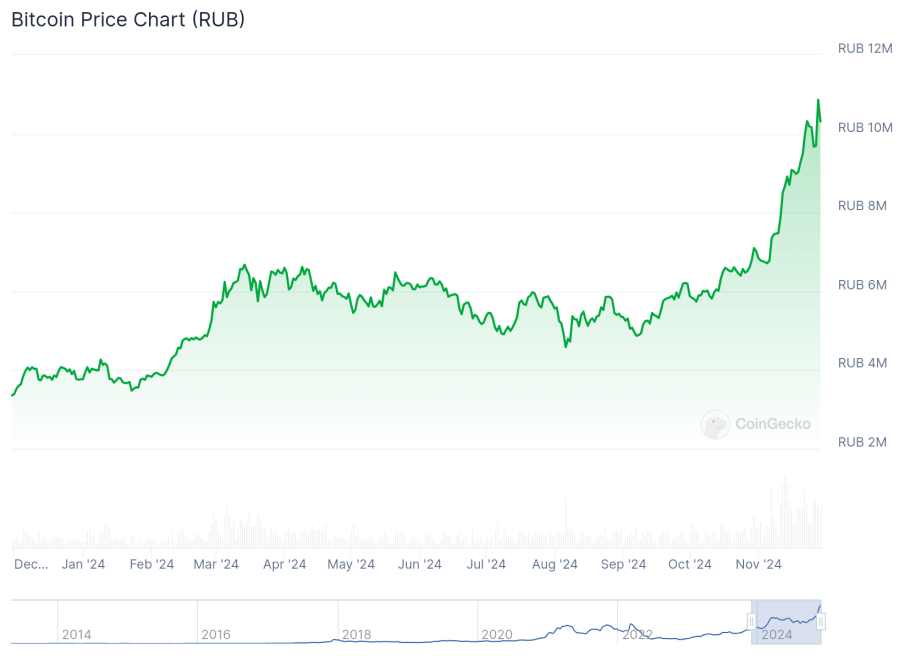

bitcoin reaches all-time high against the Russian ruble

The passage of the bill comes as the Russian ruble is in free fall on global currency markets. Year-to-date (YTD), the ruble has depreciated more than 17% against the US dollar.

This devaluation has contributed to bitcoin reaching an all-time high (ATH) against the ruble. btc is trading above 10 million rubles at the time of publication, with year-to-date gains exceeding 200% against the struggling fiat currency.

Russia has been actively leveraging cryptocurrencies in an attempt to evade sanctions that have been imposed on it since the start of the Ukraine conflict. During this year's BRICS summit in Kazan, Russia, key lawmakers proposed sell btc to international buyers to effectively bypass Western sanctions.

SimilarlyRussia expressed interest in adopting digital assets for cross-border payments in September. Earlier this year, President Putin signed a bill that gives legal status to cryptocurrency mining in the country.

Russia is also dealing with an energy crisis, forcing it to ban crypto mining in certain regions due to its energy-intensive nature. btc is trading at $95,162 at press time, down 0.9% in the last 24 hours.

Featured image from Unsplash.com, charts from CoinGecko and TradingView.com