bitcoin's recent price action has been nothing short of exhilarating, but beyond the market hype lies a wealth of on-chain data that offers deeper insights. By analyzing metrics that measure network activity, investor sentiment, and btc market cycles, we can get a clearer picture of bitcoin's current position and potential trajectory.

There are many advantages left

The MVRV Z-score compares bitcoin's market capitalization, or price multiplied by circulating supply, with its realized capitalization, which is the average price at which the last transaction was made with all btc. Historically, this metric indicates overheated markets as it enters the red zone, while the green zone suggests widespread losses and possible undervaluation.

Currently, despite bitcoin's rise to new all-time highs, the Z-score remains in neutral territory. In previous bull runs, Z scores reached highs of 7 to 10, well beyond the current level of around 3. If history repeats itself, this indicates significant room for further price growth.

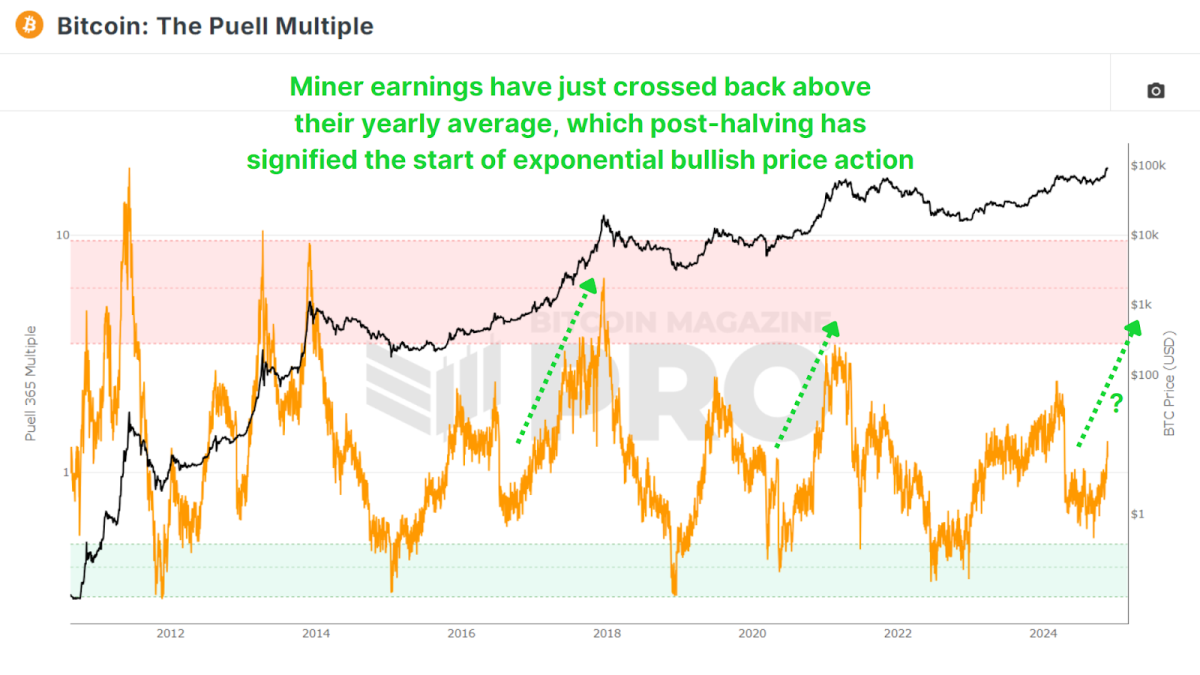

Mining profitability

The multiple Puell It evaluates the profitability of miners by comparing their daily dollar-denominated earnings with their moving average from the previous year. After the halving, miners' profits fell by 50%, leading to a several-month period of lower profits as the price of btc consolidated for most of 2024.

However, even now, as bitcoin has soared to new highs, the multiple indicates only a 30% increase in profitability relative to historical averages. This suggests that we are still in the early and mid stages of the bull market, and by comparing data patterns, it appears that we have potential for explosive growth similar to 2016 and 2020. With a post-halving reset, consolidation, and finally a recovery of the multiple level of 1.00, which signifies the exponential phase of the price action.

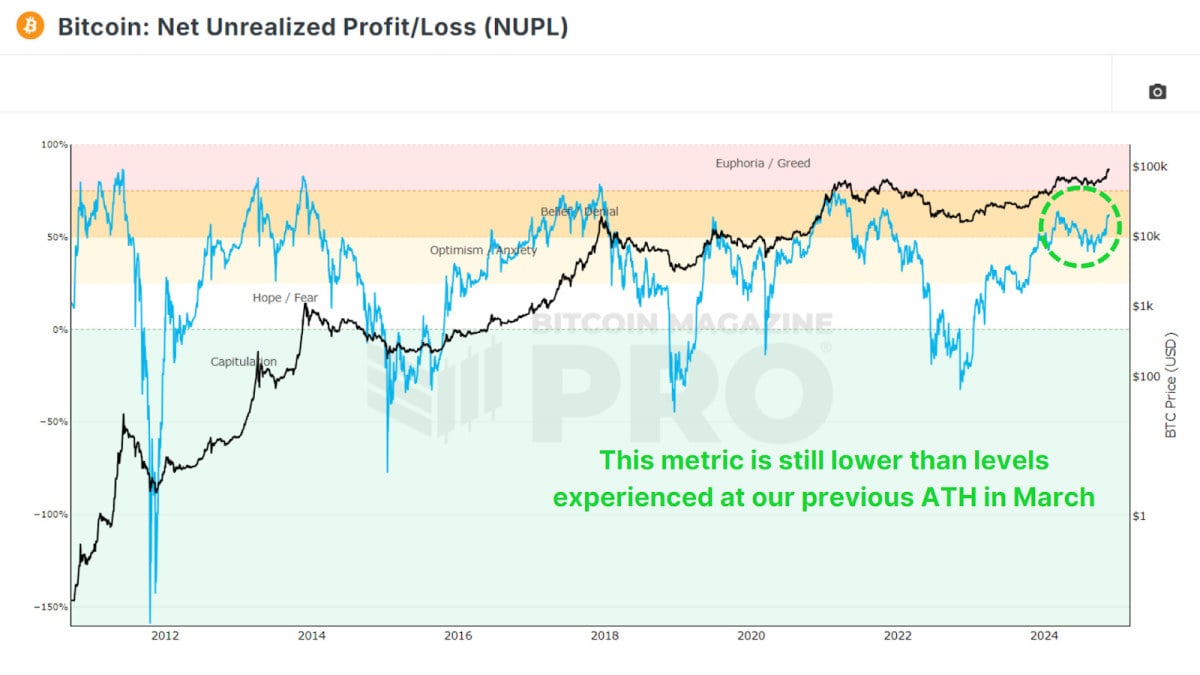

Measure market sentiment

Net unrealized gains and losses (NUPL) The metric quantifies overall network profitability, mapping sentiment into phases such as optimism, belief, and euphoria. Similar to the MVRV Z-Score, as it is derived from realized value or investor costs, it analyzes the current estimated profits or losses for all holders.

Currently, bitcoin remains in the “belief” zone, far from “euphoria” or “greed.” This is consistent with other data suggesting that there is ample room for price appreciation before market saturation is reached. Especially considering that this metric is still at lower levels than it reached earlier this year in March, when we set the previous all-time high.

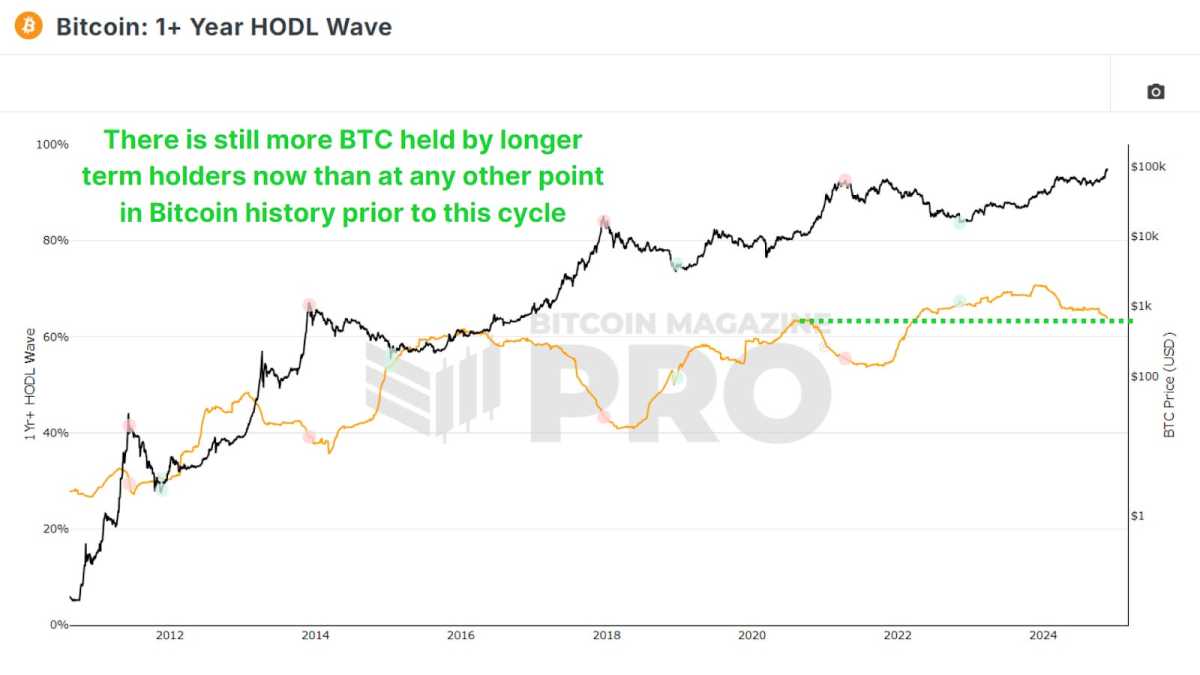

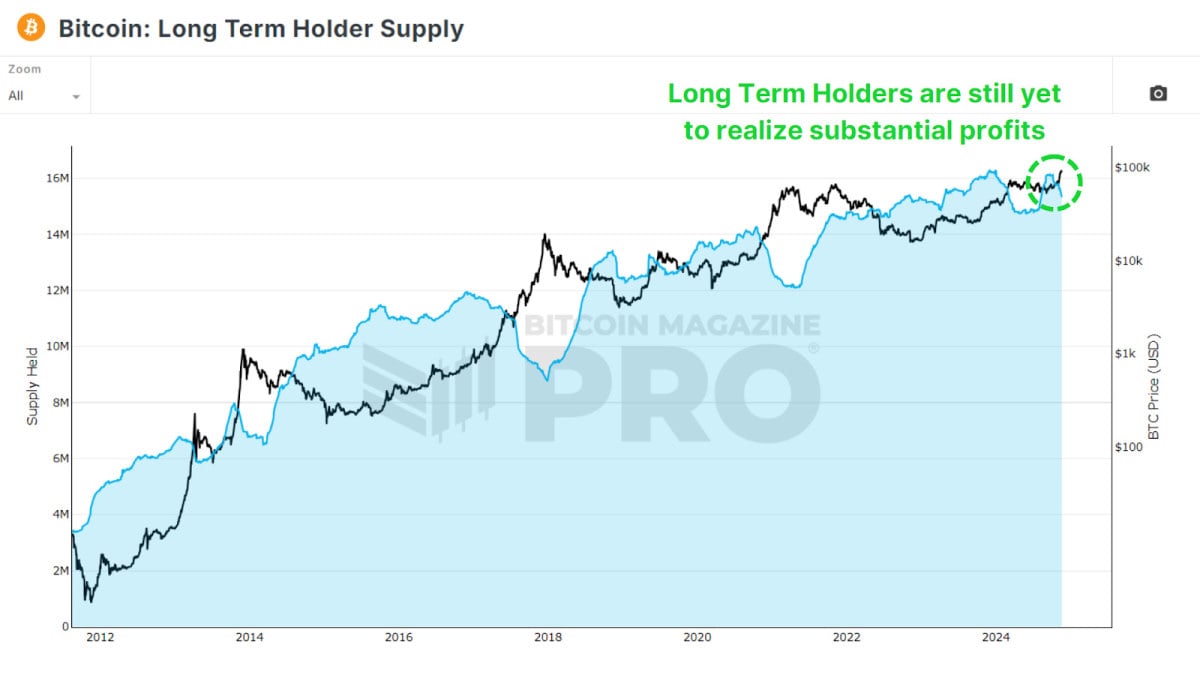

Long-term headline trends

The percentage of bitcoin held for more than one year, represented by the HODL wave of more than 1 yearremains exceptionally high, around 64%, which is still higher than at any other point in bitcoin's history before this cycle. Previous price spikes in 2017 and 2021 saw these values fall to 40% and 53%, respectively, as long-term holders began to take profits. If something similar were to happen during this cycle, we would still have millions of bitcoins left to transfer to new market participants.

So far, only around 800,000 btc have been transferred from the Long-term headline supply to new market participants during this cycle. In previous cycles, between 2 and 4 million btc changed hands, highlighting that long-term holders have not yet fully withdrawn their money. This indicates a relatively incipient phase of the current bull run.

Tracking “smart money”

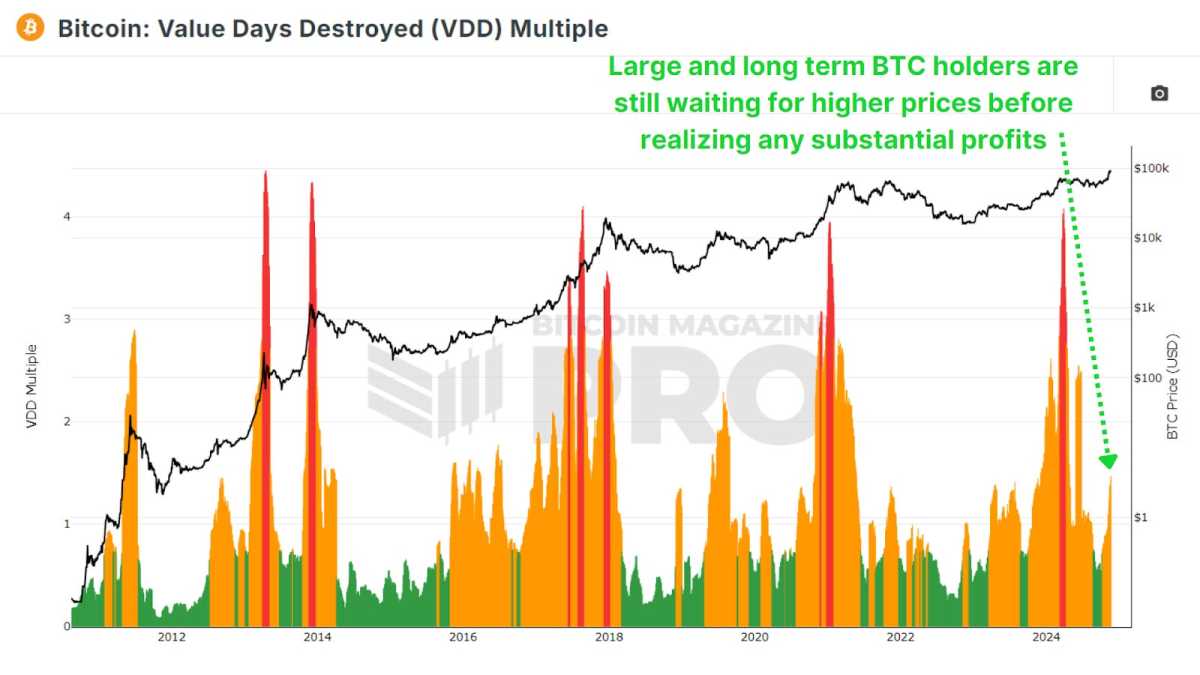

He Coin days destroyed The metric weighs transactions by the coins' holding duration, emphasizing whale activity. We can then multiply that value by the price of btc at that moment to see the Multiple Value Days Destroyed (VDD). This gives us a clear idea of whether the biggest and smartest btc holders are starting to make profits on their positions.

Current levels remain far from the red zones typically seen during market highs. This means that whales and “smart money” are not yet unloading significant portions of their holdings and are still waiting for higher prices before they start making substantial profits.

Conclusion

Despite the rally, on-chain metrics overwhelmingly suggest that bitcoin is far from overheated. Long-term holders remain largely firm, and indicators such as the MVRV Z-score, NUPL and Puell Multiple highlight room for growth. That said, some profit-taking and new market entrants signal a transition into the mid-to-late cycle phase, which could potentially hold for most of 2025.

For investors, the key takeaway is to continue to be data-driven. Emotional decisions driven by FOMO and euphoria can be costly. Instead, follow the underlying data that drives bitcoin and use tools like the metrics discussed above to guide your own investing and analysis.

For a more in-depth look at this topic, watch a recent YouTube video here: What's happening on chain: bitcoin update