This article is also available in Spanish.

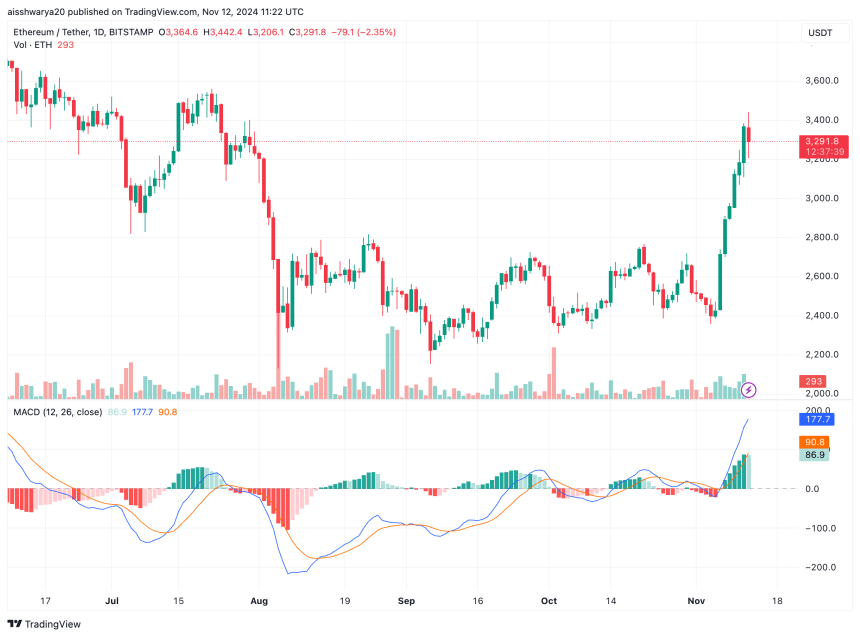

ethereum (eth) appears to be finally waking up from its slumber, rising nearly 37% in the past week following bitcoin's (btc) all-time high (ATH) rally.

ethereum spot ETFs record daily inflows

ethereum, the second-largest cryptocurrency with a market capitalization of approximately $404 billion, is now gaining ground against btc, with the platform's eth token jumping more than 35% over the past week.

Related reading

While the overall digital asset market has been boosted by Donald Trump's victory in the 2024 US presidential election, other factors may also be driving the industry's recent boom, especially for eth.

A key insight is the substantial inflow of funds into eth spot ETFs. On November 11, US-based spot eth ETFs attracted a record $295 million in daily inflows, the highest amount to date.

In comparison, the previous peak of daily inflows into the eth spot ETF was $106 million. recorded the first day these ETFs were launched in July 2024.

According to data from SoSoValue, the record inflows were led by Fidelity's FETH ETF, which raised $115.48 million.

It was followed by BlackRock's ETHA with $101.11 million, Grayscale's eth with $63.32 million, and Bitwise's ETHW with $15.57 million.

At the time of writing, the total value of net assets held in various eth spot ETFs stands at $9.72 billion, representing just over 2.41% of ethereum's total market capitalization. Meanwhile, the cumulative net outflows from all eth spot ETFs amount to $41.30 million.

eth Price Action and DeFi Resurgence

Renewed interest from institutional investors in ethereum ETFs amid record daily inflows appears to be contributing positively to eth price action.

Related reading

For much of 2024, eth lagged in price performance among major cryptocurrencies such as btc and Solana (SOL). However, Q4 2024 has the potential for a dramatic shift in eth momentum.

<a target="_blank" href="https://x.com/LeonWaidmann/status/1854090388698714519/photo/1″ target=”_blank” rel=”nofollow”>Analysis shared by Leon Waidmann, head of research at the Onchain Foundation, indicates that eth staking levels are at an ATH, while reserves of the token on crypto exchanges are heading towards all-time lows.

This combination of record staking levels and reduced supply on exchanges suggests a possible supply squeeze, which could trigger a parabolic rally for eth.

Furthermore, the eth/btc ratio appears to be recovering After prolonged losses, the trading pair rose from 0.034 to 0.040 before falling to 0.037 at the time of writing.

The next major resistance for this pair lies around 0.040, and a successful breakout from this level could lead to further gains for eth over btc. At the time of this publication, eth is approximately 32% below its ATH value of $4,878 recorded in November 2021.

Additionally, ethereum's decentralized finance (DeFi) activity appears to be harvest steam. <a target="_blank" href="https://defillama.com/chain/ethereum” target=”_blank” rel=”nofollow”>Data from DefiLlama shows that the total value locked (TVL) in ethereum-based DeFi protocols currently stands at $62.36 billion, up from around $24 billion in November 2023.

More than half of this TVL is tied to the eth Lido staking platform, which holds close to $33 billion. Lido is followed by DeFi lending protocol Aave with $15.21 billion and EigenLayer with $14.57 billion.

That said, concerns Questions remain regarding eth's “ultrasonic money” narrative due to the token's high issuance rate. At press time, eth is trading at $3,291, up 3.1% in the last 24 hours.

Featured image from Unsplash, charts from x.com, DefiLlama.com and TradingView.com