Image source: Getty Images

Imagine investing £100,000 in a SIPP share and then sitting back watching the value of the share grow to £1.3m.

I know, £100,000 is a lot to invest, especially as I believe in keeping a diversified SIPP, so I wouldn't invest £100,000 in a share unless I had a much larger reserve of money in my SIPP to invest.

Still, turning £100,000 into £1.3 million sounds great to me!

In this example, I'm not even assuming any increase in stock price. A rising share price could speed things up, although the opposite is also true.

Take the long-term approach

When I talk about speeding things up, I should mention that my focus here is on the long term.

I think that makes sense. In this example, I am considering a period of 25 years.

In the context of a SIPP, I see it as a practical deadline. Many investors plan to hold their SIPP for several decades.

The power of capitalization

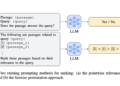

So how could I hope to turn my £100,000 into £1.3m even in 25 years, if the price of the share I buy doesn't move an inch?

Simple: capitalize dividends.

Compounding 10.8% per year, my £100,000 investment would end up being worth £1.3 million after a quarter of a century.

FTSE 100 stock yielding 10.8%

However, this brings me to the question of whether a blue-chip company FTSE 100 The stock would offer something close to a 10.8% yield. After all, that's triple the average performance of the FTSE 100 right now.

One almost did: Vodafone. But its 10.6% yield is about to collapse as the company has announced plans to cut the dividend in half. This is a useful reminder that no dividend is ever guaranteed to last, and a high yield may be a sign that the City has doubts about whether it will.

Another FTSE 100 share has a yield of 10.8% and has not announced plans to cut its dividend. In fact, quite the opposite: this year it affirmed its plan to continue increasing pay per share annually.

that company is Phoenix (LSE: PHNX), a financial services company that bills itself as the country's largest long-term savings and retirement company.

It has around 12 million customers and operates under brands such as Standard Life and Sun Life.

Looking to the future

One of the challenges when analyzing financial services companies is that profits are not always useful. For example, fluctuating asset valuations can lead to higher or lower earnings figures that do not necessarily help assess the underlying financial health of a company.

The positive side is that Phoenix is in a large, well-established business area and has a very significant customer base and deep expertise in a specialized field. Those attributes could help the company, which had a turnover of £4.9bn last year, generate enough free cash flows to maintain its generous dividend.

That may not happen; One risk I see is that a slowdown in the housing market will affect the valuation of Phoenix's mortgage portfolio, forcing it to write down valuations.

But overall, I think Phoenix is a stock that investors interested in long-term passive income streams should consider.