Mt. Gox is in the news again, this time, bitcoin-to-new-wallets-amid-repayment-plans/” target=”_blank” rel=”noopener nofollow”>transferring 32,371 Bitcoinsvalued at $2.19 billion at current prices, to an undisclosed address. The transaction of a defunct crypto exchange occurred when the market price of bitcoin was stuck in the range of $65 thousand to $73 thousand and anticipating the results of the US elections.

Arkham Intelligence was one of the first companies to track the movement, claiming that 32,371 btc had moved from the address. Arkham said that two transfers were made from the suspected Mt. Gox wallet: the first, amounting to 30,371 tokens to a wallet with an address starting with “1FG2Cv…” and the second tranche, amounting to 2,000 tokens to a wallet still cold property of the old exchange, before being moved to another unnamed destination.

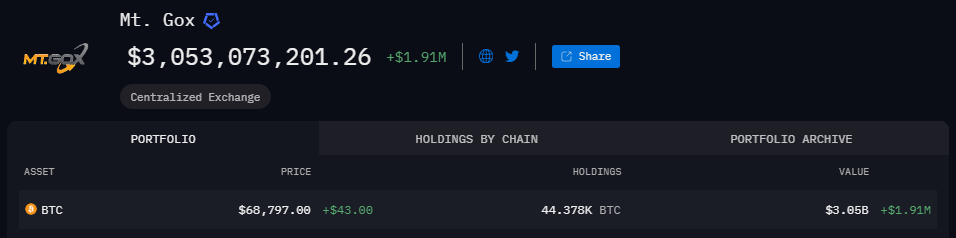

Source: Arkham Intelligence

Mt. Gox still has over 44k btc

According to an estimate by Arkham Intelligence, the defunct exchange has 44,378 btc in its inventory, which is equivalent to about $3 billion at current prices. Many experts say the portfolio's current movement is related to its planned liquidation and payment to creditors after it filed for bankruptcy in 2014.

Although the exchange is no longer operational, its crypto wallets remain active. For example, the exchange recently moved 500 tokens (around $35 million) to undisclosed addresses. The company did not share any information about this recent btc transfer. Still, many observers speculate that it is part of his efforts to cover his obligations as part of the settlement process.

Bankruptcy due to piracy

Before filing for bankruptcy, Mt. Gox was considered the largest crypto exchange platform. Founded in 2020, it processed over 70% of global crypto transactions at its peak.

Then, a series of attacks and security breaches between 2011 and 2014 hit the company. During this period, the exchange lost around 850 thousand btc, making it one of the largest cryptocurrency hacks in history. Although law enforcement managed to trace and recover around 140,000, this was not enough to save the exchange, which eventually declared bankruptcy.

Extended refund period

As part of the stock market's bankruptcy and protection plan, it must pay its creditors and former customers. The exchange administrator extended the payment deadline by one year, making the last week of October 2025 its new deadline.

Mt Gox faces a difficult payment process involving billions of dollars. Due to its size, some analysts are concerned that the exchange's former creditors could liquidate their digital assets, triggering a liquidation. The leading digital asset is trading at the $68,000 level and remained almost unchanged for the rest of the day.

Featured image of Protos, TradingView chart