The US Securities and Exchange Commission (SEC) filed a notice from Wells to Immutable regarding its IMX token sales. The SEC's argument is related to a 2021 blog post about pre-launch investment made in IMX tokens priced at $0.10 or a $10 pre-100:1 split.

Immutable disputed the SEC's judgment, saying the price was inaccurate; therefore, the charge is “incorrect” since no exchange occurred between the parties.

Immutable (IMX) was one of the popular gaming-focused projects in 2021, a time of increasing popularity of play-to-earn (P2E) blockchain projects. The blockchain project included an nft marketplace and an L2 scaling solution, primarily serving third-party game developers.

<blockquote class="twitter-tweet”>

Immutable received a Wells notice from the SEC, the latest in its de facto policy of regulation through enforcement. We received this within hours of our first conversation, on a clearly accelerated timeline to arrive before the election.

Unfortunately, stories like this are becoming…

– Immutable (@Immutable) twitter.com/Immutable/status/1852093814112161932?ref_src=twsrc%5Etfw” rel=”nofollow noopener” target=”_blank”>October 31, 2024

Wells Notice Targets 'IMX Token Sale'

Immutable is a leading Australian blockchain that launched a $320 million pre-sale. About 14% of IMX tokens went public. The SEC believes that the IMX tokens themselves during their launch violated some laws, hence the decision to file the notice.

In the US, companies and individuals can receive a Well notice of the agency if they are investigated for possible violations. Immutable immediately responded to the notice, saying the agency was deliberately tough on startups despite little evidence of wrongdoing.

After the notice was issued, the agency contacted the company to discuss. With a Wells notice filed, Immutable could soon face a lawsuit.

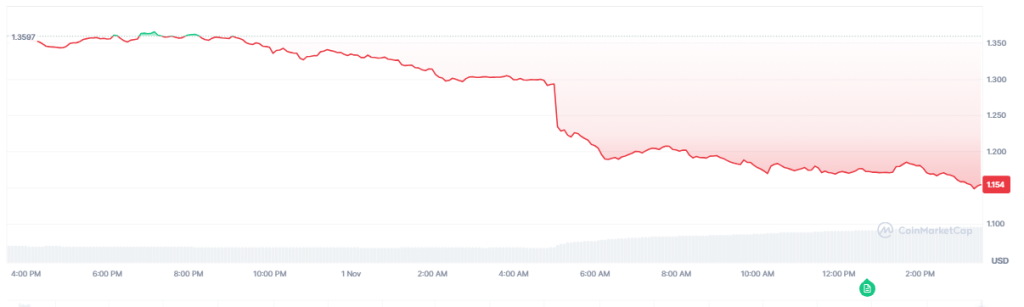

Token price drops to one-month low

The recent news about Immutable and the possible investigation spooked many traders, sending the token's price up to $1.22 from $1.37, a one-month low. However, the SEC issuance was also useful for the company since the volume of its x/open-interest/” target=”_blank” rel=”noopener nofollow”>Open interest increased. For Immutable, open interest covers currency-margined and USD stablecoin-margined contracts.

Source: x/open-interest/" target="_blank" rel="noopener nofollow">Coinalyze

Recently, IMX's open interest went from a low of $22 million to a high of $27 million in just a few hours. While many consider IMX risky, analysts see a possible quick recovery from its lows. Major exchanges including Coinbase and Binance have IMX.

IMX price down in the last 24 hours. Source: x/" target="_blank" rel="noopener nofollow">CoinMarketCap

Immutable criticizes SEC for aggressive enforcement

Australia's Immutable shared their frustrations on twitter/x and said these advisories and investigations are becoming less and less surprising. The company used the experiences of other blockchain companies such as Coinbase, OpenSea and Uniswap as examples. Immutable added that the agency's recent aggressive measures now extend to gaming.

In the same post, the company reiterated its commitment to the industry and said it would continue to build to support gaming. If necessary, the company will also fight and defend the rights of players. So far, Wells' notices from the SEC have not resulted in the delisting of companies or projects, except for XRP, which was removed from Binance for a year.

Featured image from TechCrunch, chart from TradingView

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>