bitcoin surpassed $71,000 on Tuesday morning to lead other major altcoins into an uptrend a week before the US election. According to CoinGecko tracking, bitcoin” target=”_blank” rel=”noopener nofollow”>bitcoin touched $71,075 after falling last week due to rumors circulating about a possible investigation into Tether and the ongoing conflict in the Middle East.

Experts and industry observers say that bitcoin's recent breakout is related to increased inflows into bitcoin ETFs and excitement for November 4. united states presidential elections favoring the crypto industry. Despite erratic bitcoin price movements in recent days, bitcoin is currently riding on bullish sentiment.

Source: bitcoin" target="_blank" rel="noopener nofollow">Coingecko

Is a bull run coming for bitcoin?

Last week was a difficult time for holders and the market as bitcoin fell below $66,000 but immediately recovered and consolidated in the $67,0000 to $68,000 range over the weekend.

bitcoin then broke out and hit $71,075, its best performance in the last four months. According to CoinGecko, Tuesday's latest bitcoin price movement is supported by $51 billion in trading volume, double the amount generated on Monday.

x/MXoTqnTM/” width=”2475″ height=”1163″/>

bitcoin market cap currently at $1.4 trillion. Chart: TradingView.com

Observers like Peter Brandt said that bitcoin's latest price action reflects a new bullish phase after the halving. In a twitter post, the experienced trader shared that bitcoin has completed its “inverted expanding pyramid” and the next follow-up is critical. Brandt further explained that this could be the post-bitcoin halving run.

btc whale trades, ETF inflows boost market

bitcoin's recent price surge is attributed to increased trading since twitter&utm_medium=sns&utm_campaign=quicktake&utm_content=mignolet” target=”_blank” rel=”noopener nofollow”>bitcoin whales and ETF entries. According to CryptoQuant's Mignolet, the recent purchases can be attributed to whales on Binance, who appear to be the net buyers of bitcoin during Asian trading hours.

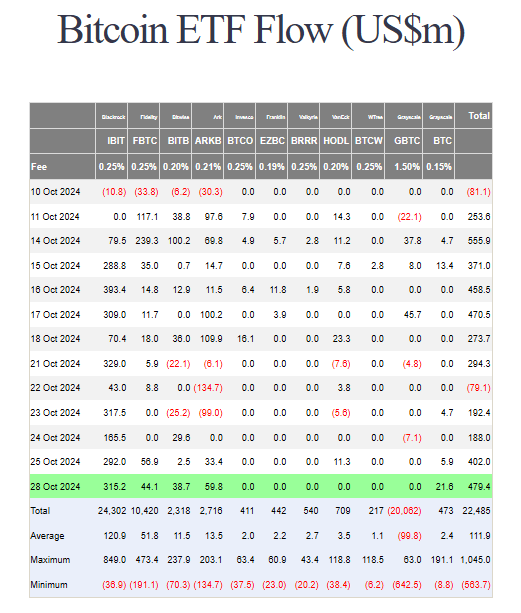

Fountain: btc/” target=”_blank” rel=”noopener nofollow”>Far Side Investors

Furthermore, bitcoin ETF trading has mainly contributed to the higher-than-usual trading volume. These funds added up to a net inflow of more than 47,000 Bitcoins in two weeks. Besides bitcoin, Other Major Altcoins Too joined the wave. Dogecoin, for example, rose 15% due to Trump's popularity. Then, there is Shiba Inu (SHIB), which jumped 8%, Ether (eth) 4.9%, and Cardano ADA improved 3%.

Image: Zerocap

Are the following higher highs?

For many experienced traders, Tuesday's big jump sets the tone ahead of the US elections in November. Cryptocurrency traders and supporters expect bitcoin to maintain its gains or even hit new highs regardless of the outcome of the presidential election.

Traders have long favored and anticipated that Donald Trump will win the election. For many, a Trump victory is a bullish catalyst for bitcoin as it has some pro-cryptocurrency policies. It also helps that Trump gets the endorsement of Elon Musk, a strong supporter of bitcoin and blockchain technology. Democrats, on the other hand, have not drawn up specific policies but have plans to introduce regulations in the industry.

Even financial analysts contribute their opinions and projections for the US elections. According to some analysts at Standard Chartered, bitcoin could reach $73,000 on November 5. If Trump wins, they predict the price will reach $80,000 or even $125,000 before the end of the year, especially if the Republicans win Congress.

Featured image of Dall-E, TradingView chart