bitcoin price cycles have long been a source of intrigue for investors and analysts alike. We can gain insight into potential price movements by comparing current trends to previous cycles, especially now that bitcoin appears to be reaching the end of its consolidation period; many are wondering if the next bullish leg is just around the corner.

Comparing bitcoin cycles

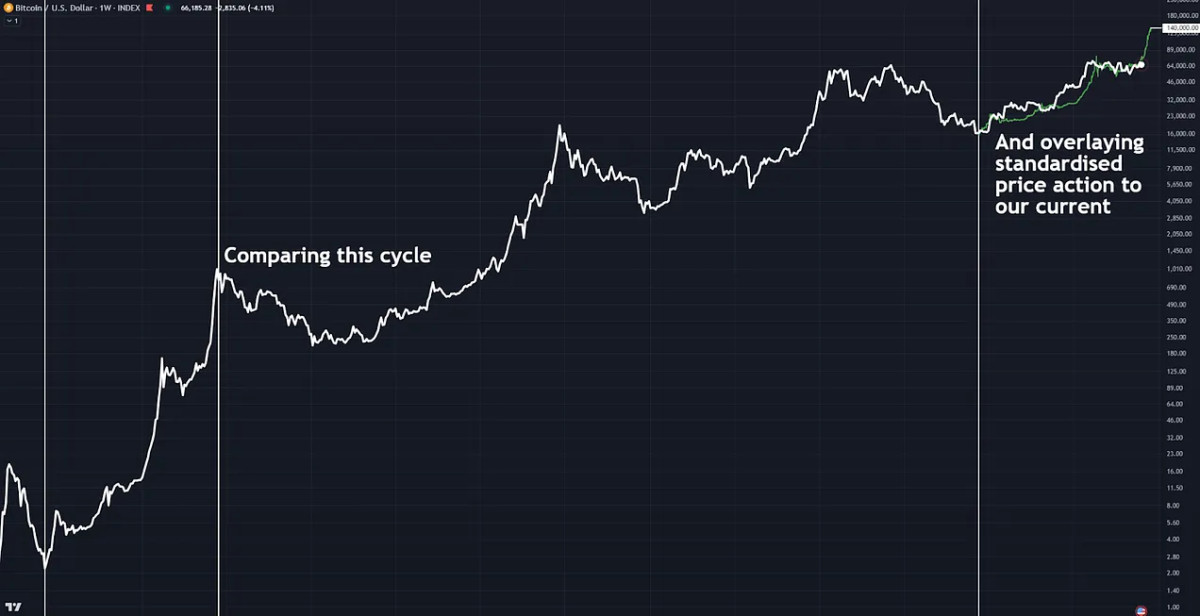

To begin with, it is crucial to observe bitcoin-portfolio/btc-growth-since-cycle-lows/”>How bitcoin has performed since hitting its recent cycle low. As we examine the data, a clear picture begins to form: bitcoin's current price action (black line) shows similar patterns to previous bull cycles. Although it has been a hectic period of consolidation, where the price has been relatively stagnant, there are key similarities when we compare this cycle to those of 2015-2018 (purple line) and 2018-2022 (blue line).

The current situation, in terms of percentage gains, is comparable to the 2018 and 2015 cycles. However, this comparison only scratches the surface. Price action alone doesn't tell the whole story, so we need to dig deeper into investor behavior and other metrics that shape the bitcoin market.

Investor behavior

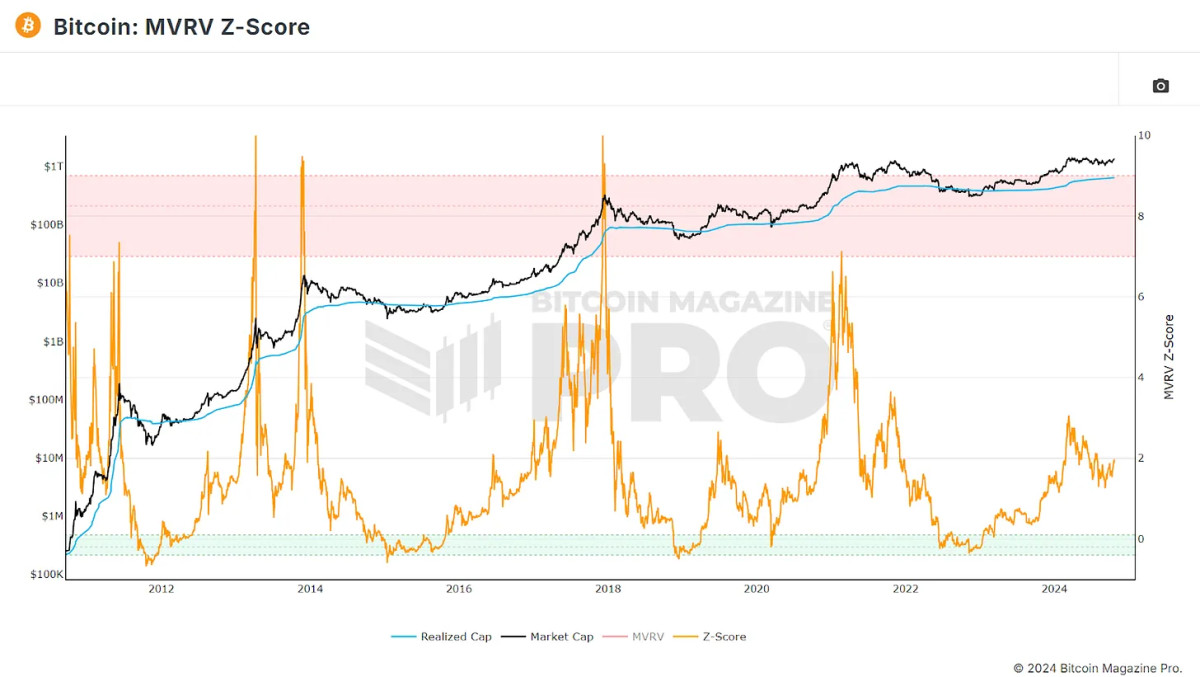

A key metric that gives us insight into investor behavior is the MVRV Z-score. This ratio compares bitcoin's current market price to its “realized price” (or cost basis), which represents the average price at which all bitcoin on the network was accumulated. The Z-Score then simply standardizes the raw MVRV data to btc volatility to exclude extreme outliers.

Analyzing metrics like this, rather than focusing exclusively on price actions, will allow us to see patterns and similarities in our current cycle with previous ones, not only in dollar movements but also in investor habits and sentiment.

Correlated movements

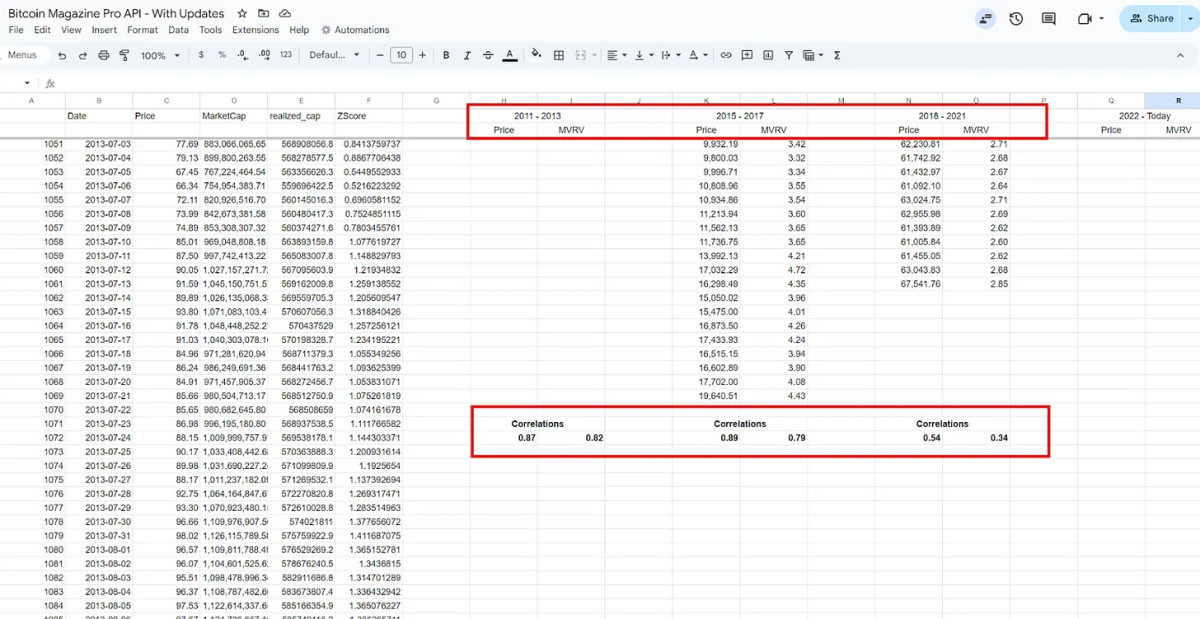

To better understand how the current cycle aligns with previous ones, we turned to data from bitcoin Magazine Pro, which offers detailed information through its API. Excluding our Genesis cycle as there is little correlation and isolating the price and MVRV data from bitcoin's lowest closing prices to its highest points in our current and previous three cycles, we can see clear correlations.

2011 to 2013 Cycle: This cycle, characterized by its double peak, shows a strong 87% correlation with current price action. The MVRV ratio also shows a high correlation of 82%, which means that not only the price of bitcoin behaves similarly, but also the behavior of investors in terms of buying and selling.

2015 to 2017 Cycle: This cycle is actually the closest in terms of price action, with a 89% correlation to our current cycle. However, the MVRV ratio is slightly lower, suggesting that while prices follow similar trajectories, investor behavior could be slightly different.

2018 to 2021 Cycle: This most recent cycle, although positive, has the lowest correlation with current trends, indicating that the market may not be following the same patterns as it was just a few years ago.

Are we in for another double peak?

The strong correlation with the 2011-2013 cycle is especially striking. During that period, bitcoin experienced a double peak, where the price rose to new all-time highs twice before entering a prolonged bear market. If bitcoin follows this pattern, we could be on the verge of major price moves in the coming weeks. After overlaying this period's price action fractal onto our current cycle and standardizing the returns, the similarities are instantly noticeable.

In both cases, bitcoin had a rapid rise to a new high, followed by a long, choppy period of consolidation. If history repeats itself, we could soon see a massive price rally, potentially up to around $140,000 before the end of the year, taking into account diminishing returns.

Investor Behavior Patterns

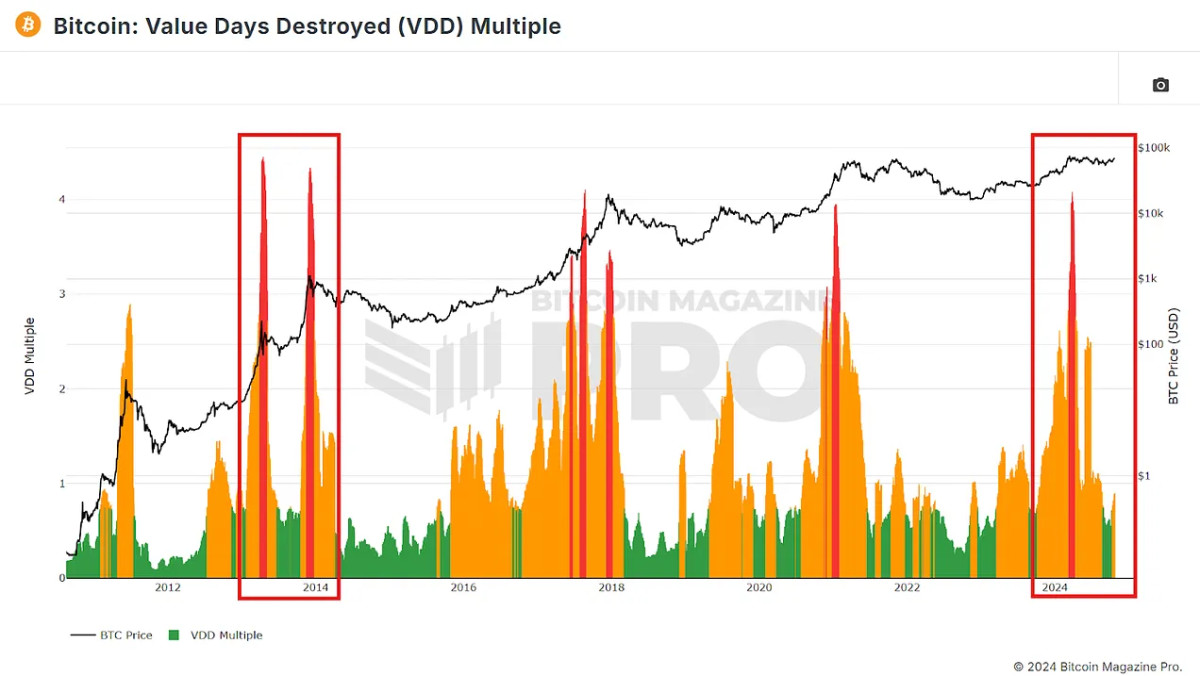

Another valuable metric to examine is the Days of value destroyed (VDD). This metric weights btc movements by the amount moved and the time since the last transfer and multiplies this value by the price to provide insight into long-term investor behavior, specifically profit-taking.

In the current cycle, VDD has shown an initial spike similar to the red spikes we saw during the 2013 double peak. This period leading up to btc hitting a new all-time high earlier this year before a sustained period of consolidation could make May we reach new highs soon again if this double peak cycle pattern continues.

A more realistic scenario

As bitcoin has grown and matured as an asset, we have seen long cycles and diminishing returns in our two most recent cycles compared to our initial two. Therefore, btc is probably more likely to follow the cycle where we are seeing the strongest correlation in price action.

Figure 6: Overlaying a 2017 cycle fractal on our current price action.

If bitcoin follows the 2015-2017 pattern, we could still see new all-time highs before the end of 2024, but the rally would likely be slower and more sustainable. This scenario predicts a price target of around $90,000 to $100,000 by early 2025. After that, we could see continued growth throughout the year, with a potential market peak in late 2025, although a peak of $1.2 million if we follow this pattern exactly may be optimistic!

Conclusion

Historical data suggests we are approaching a critical tipping point. Whether we follow the explosive double-peak cycle of 2011-2013 or the slower but steady rise of 2015-2017, the outlook for bitcoin remains bullish. Tracking key metrics like the MVRV ratio and days of value destroyed will provide more clues as to where the market is headed, and comparing correlations to our previous cycles will give us a better idea of what may be coming.

With bitcoin primed for a breakout, whether in the coming weeks or in 2025, if btc even remotely follows the patterns of any of our previous cycles, investors should prepare for significant price action and possible new all-time highs sooner than late.

For a more in-depth look at this topic, watch a recent YouTube video here: Comparing bitcoin Bull Runs: What Cycle Are We Following?