This article is also available in Spanish.

The recent rise in appeal of spot bitcoin exchange-traded funds (ETFs) in the United States has temporarily ceased.

Related reading

On Tuesday, these funds suffered a reversal, resulting in btc/” target=”_blank” rel=”nofollow”>net outflows of $79.01 millionafter an extraordinary seven-day streak of positive entries. The source of this data is Farside Investors, a company specialized in the analysis of ETF flows.

A brief obstacle

The $79 million outflow represents a significant shift in sentiment among investors who had previously shown strong interest in bitcoin” target=”_blank” rel=”nofollow”>bitcoin ETF. In the span of two days last week, the market attracted around $1 billion in inflows, implying strong demand for these financial products.

The main cause of this negative change was Ark's ARKB and 21Shared, which resulted in a substantial outflow of $134.7 million.

BlackRock's IBIT, the top-performing bitcoin ETF by net assets, netted $43 million. Fidelity's FBTC and VanEck's HODL, which received $8.8 million and $3.8 million, respectively, also helped. There were no new flows into the remaining eight funds, including Grayscаle's GBTC, during the day.

However, bitcoin ETFs could generate over $21 billion to date. This number clearly signifies the growing use of bitcoin as a new asset class and will only lead to more hedge funds taking larger positions.

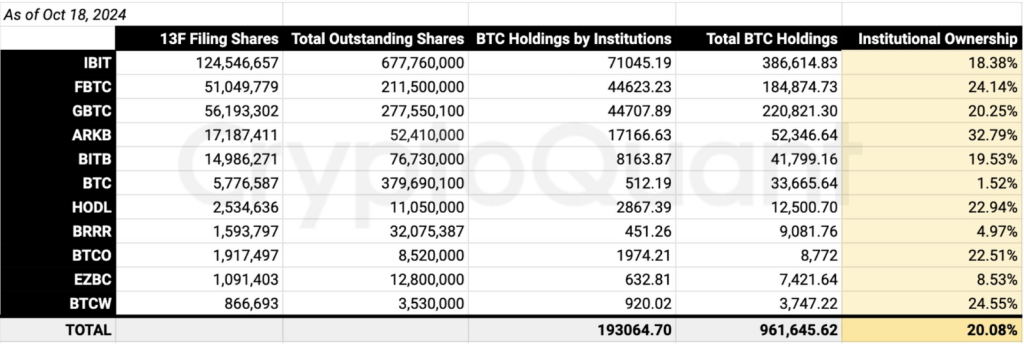

US-traded bitcoin spot ETFs have also seen significant interest from institutional investors, holding 20% of the market as of October 22.

<blockquote class="twitter-tweet”>

US institutional ownership twitter.com/hashtag/bitcoin?src=hash&ref_src=twsrc%5Etfw” rel=”nofollow”>#bitcoin Spot ETFs are around 20%, with asset managers holding 193,000 btc (based on Form 13F filings). pic.twitter.com/9YTOEH3G5w

– Ki Young Ju (@ki_young_ju) twitter.com/ki_young_ju/status/1848689728423661875?ref_src=twsrc%5Etfw” rel=”nofollow”>October 22, 2024

Institutional demand remains strong

Regardless, while the latest changes in ETF flow have been significant in themselves, they cannot distract from what is a continued push toward institutional adoption of bitcoin. Among the major companies that have made large investments in these funds are Goldman Sachs and Millennium Management.

The SEC's approval of options trading on 11 bitcoin ETFs will help investors manage their exposure to bitcoin, increasing interest.

Through more efficient position hedging made possible by options trading, investors can help stabilize the market and reduce volatility over time. Analysts maintain that this would attract more institutional money to the industry, thus supporting bitcoin's reputation as a credible investment tool.

bitcoin ETF: Looking Towards the Future

Although capital outflows may cause concern, many analysts are positive about bitcoin ETFs. The SEC's approval of options trading is a game-changer that could improve market efficiency and liquidity.

Bringing more institutional players into the space is likely to change the dynamic. The current pause in capital inflows could only be a temporary phenomenon; Investors are repositioning their strategies given the change in market conditions.

Related reading

The outlook for bitcoin spot ETFs, long-term, appears quite positive with the current surge in adoption from the institutional space and bitcoin trading at or near three-month highs.

Recent outflows from spot bitcoin ETFs may indicate a temporary setback; However, the prevailing trend of increased institutional interest and regulatory support indicates that this asset class is here to stay. Investors will closely monitor the rapid development of this market for new developments.

Featured image from The Rio Times, chart from TradingView

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>