This article is also available in Spanish.

Solana (SOL) remains strong above the $160 mark after the broader market saw a healthy drop to previous demand levels. Despite the drop, Solana has shown resilience, although the last few hours have been marked by short-term volatility with rapid price fluctuations. Investors are closely monitoring the next moves as Solana navigates this uncertain phase.

Related reading

Top analyst Carl Runefelt recently shared technical analysis suggesting a possible rise for SOL in the coming days, with a target of $176. His analysis highlights key bullish patterns, but concerns about the broader market correction could drag Solana lower if the correction intensifies.

With the market constantly changing, the next few days will be crucial for SOL. Investors closely monitor signs of strength or weakness that could influence price action. While optimism remains about a potential rally, caution is warranted as the market correction unfolds.

Solana tests previous offer as demand

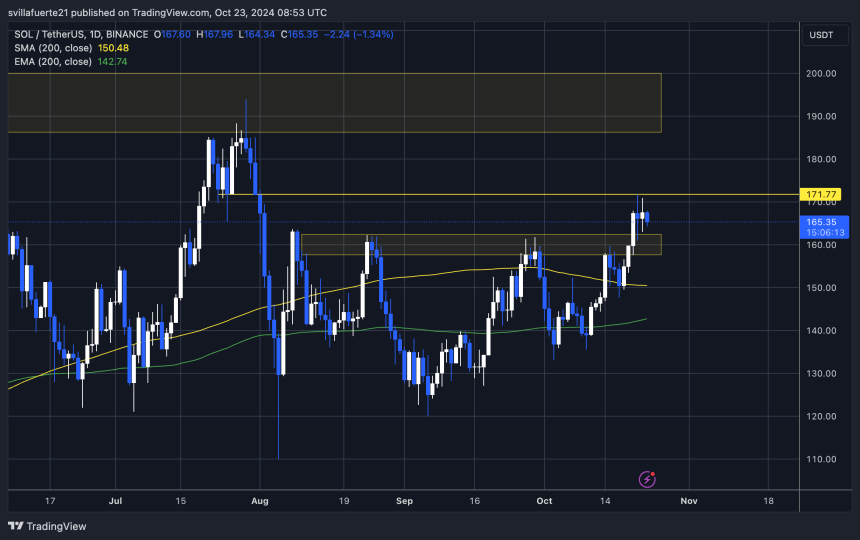

Solana is currently at a critical level, holding strong above $160, a price that had previously acted as resistance since early August. SOL broke above this level and found support, therefore indicating a potential change in the monthly trend that has kept the price contained. Investors are watching closely to see if this change will lead to continued bullish momentum.

crypto analyst and investor Carl Runefelt recently x.com/TheMoonCarl/status/1848757011820785948″ target=”_blank” rel=”nofollow”>shared a technical analysis on xwhich offers insight into Solana's near-term prospects. It revealed a 1-hour chart showing a symmetrical triangle, a bullish pattern that often precedes strong price movements.

The top line of this triangle sits around $168, and Runefelt suggests that if SOL manages to break above this level, the next target would be $176. This would mark a significant push towards new local highs, further solidifying Solana's uptrend.

As Solana continues to hold above $160, the market is waiting. Investors are being patient and aware that the next few hours and days could be pivotal for SOL price action.

Related reading

If the bullish pattern materializes and the price breaks out, it could spark a significant rally. Until that breakout occurs, however, traders are cautious, knowing that short-term volatility could still impact Solana's performance.

Technical levels to follow

Solana is currently trading at $165 after facing a rejection from the $171 mark, a key resistance level that may keep the price down for a few days or weeks. Despite this setback, SOL has shown resilience, rebounding strongly from the 200 daily moving average (MA) at $150 and successfully breaking above the $160 resistance. This breakout is a significant breakout, indicating bullish potential once The market in general begins to rise again.

Staying above the $160 level is crucial for SOL as it reflects investor confidence and signals the strength of the price action. Maintaining this support level would indicate optimism about Solana's ability to recover and reach new yearly highs in November.

Related reading

The next few days will determine whether SOL can maintain the bullish momentum or if a prolonged consolidation below $171 is in store. Investors are closely watching for signs of strength and continued upward momentum.

Featured image of Dall-E, TradingView chart