Image source: Getty Images

Phoenix group holdings (LSE:PHNX) can be a brilliant stock for investors who want to make as much second income as possible.

The pension, savings and life insurer offers the highest dividend yield on the market. FTSE 100currently paying 10.18% annually. Better yet, for investors who like a bargain, Phoenix's share price has fallen 10.49% in the last month. That means a lower price of entry, higher revenue.

I bought Phoenix in January and again in March. Should I take this opportunity to do a shopping hat-trick?

Stellar FTSE 100 dividend stock

I have already received two generous dividend payments and the third will arrive in my account on October 31st. For a while, I also enjoyed the share price growth, but alas, last month's sell-off changed that and I'm back where I started.

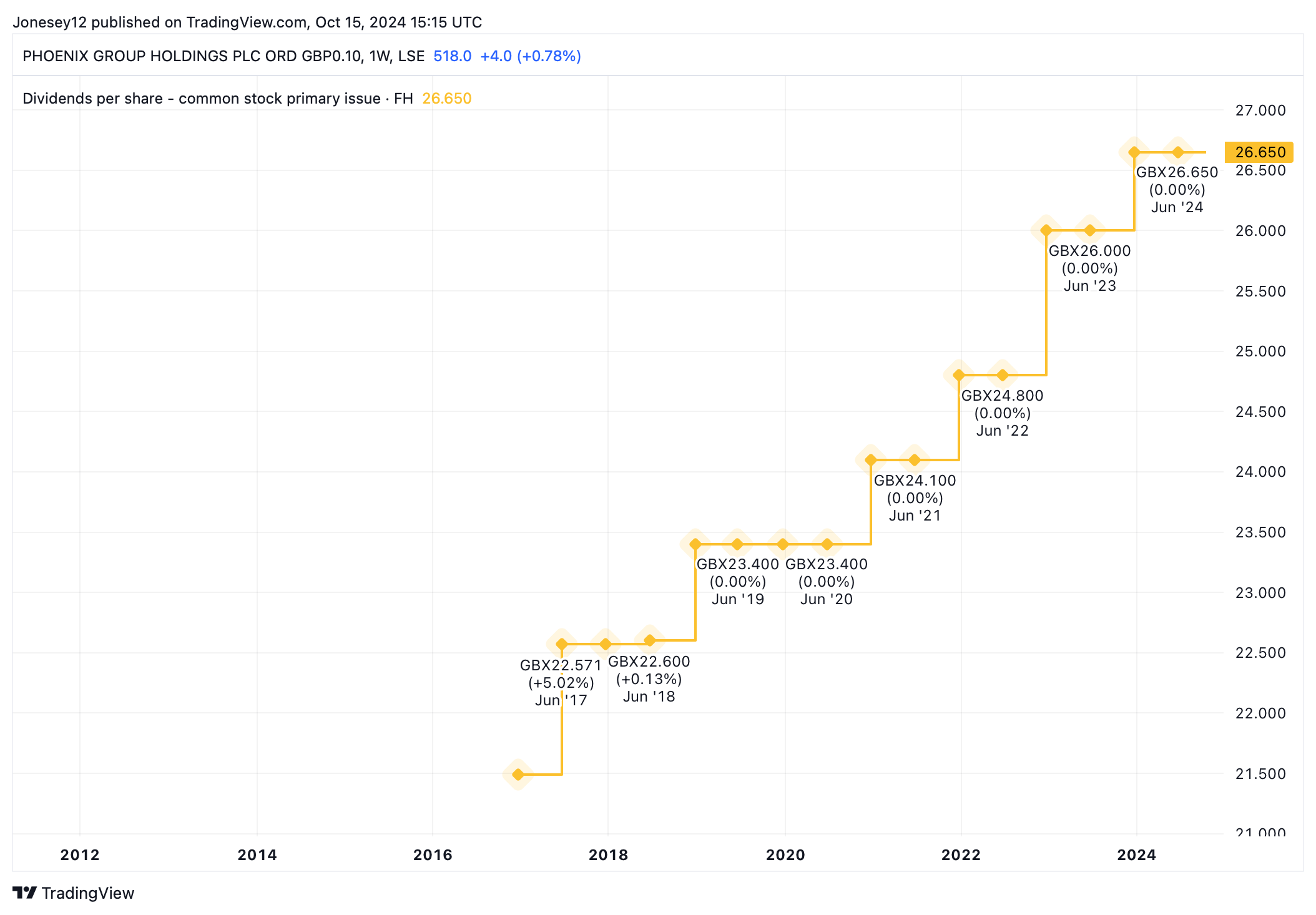

If current performance holds, I will double my money in just over seven years. Phoenix has a good track record of increasing dividends, as this chart shows.

Chart by TradingView

However, there is an obvious problem. Will the stock price ever grow? And this raises a second question. Does it matter if it doesn't?

To be fair, Phoenix stock is up 11.14% over the past year. The disadvantage is that they have dropped 25.72% in five. That double-digit return won't seem so unmissable if my capital is eroding at the same time.

At first glance, the markets appear to have been tough on Phoenix. In full-year 2023, it delivered a strong 13% rise in IFRS-adjusted operating profit to £617m, driven by strong growth in its pensions and savings business.

It looks to start 2024 in a similar vein, posting a 15% rise in first-half adjusted operating profits to £360m on September 16. However, the company's accounts are a bit difficult to understand and the bottom line after tax showed a loss of £646m. The board put that in “adverse economic variations due to higher interest rates and global actions that are a consequence of our SII hedging approach”. Maybe the markets aren't being so hard on Phoenix after all.

I would like to see Phoenix's stock price rise.

The dividend still looks strong, with total cash generation in the first half up 5.8% to £950m. Phoenix is now aiming to reach the top end of its £1.4bn to £1.5bn target range in 2024.

The stock could get a boost as analysts forecast margins will rise from 5.7% to 13% this year. The 14 analysts offering one-year price targets have an average forecast of 575.5 pence per share, up 11.14% from the current 517.5 pence. That's probably all we can hope for, but it would give a total return of over 20%. That is correct.

Despite last month's drop, Phoenix doesn't look particularly cheap, trading at 15.78 times earnings, roughly in line with the average price-to-earnings ratio of the FTSE 100. The price-to-sales ratio is 1.1, which It means investors pay 110p for every £1 in sales.

The company needs to grow to impress investors, but it operates in a mature and competitive market, at an uncertain time. You may have difficulty complying.

I won't sell my Phoenix shares, but I won't buy any more today. They offer a brilliant second income, but I'm not convinced I can live on dividends alone.