Ether (ETH), the second-largest cryptocurrency by market cap, has seen a steady decline in exchange supply over the past six months post-merger. The Ethereum network underwent a major network upgrade in September last year, moving from a Proof-of-Work (PoW) network to a Proof-of-Stake (PoS) network and the event was dubbed the Merge.

According to on-chain data shared by cryptanalysis group Santiment, the amount of ETH available on exchanges continues to fall. Since the merger, there is 37% less ETH on exchanges. A steady decline in supply on exchanges is considered a bullish sign, as there is less ETH available to trade or sell.

There was a total of 19.12 million ETH worth $31.3 billion traded in September prior to the Merger. The number has now decreased to 13.36 million ETH worth $19.7 billion in the second week of February.

A significant part of the ETH supply is moving to self-custody, while many traders are also preferring to stake with the Shanghai update just around the corner. Shanghai, Ethereum’s next major upgrade, is scheduled to launch in March. The Shanghai hard fork will integrate more improvement proposals for network improvements and allow participants and validators to withdraw their shares from the Beacon Chain.

Currently, 16 million ETH, or 14% of the total supply, is staked on the Beacon chain. At the current price of ETH, it amounts to roughly $25 billion, a sizeable amount that will gradually become liquid after the Shanghai hard fork.

Related: What’s in and what’s out for Ethereum’s Shanghai Update

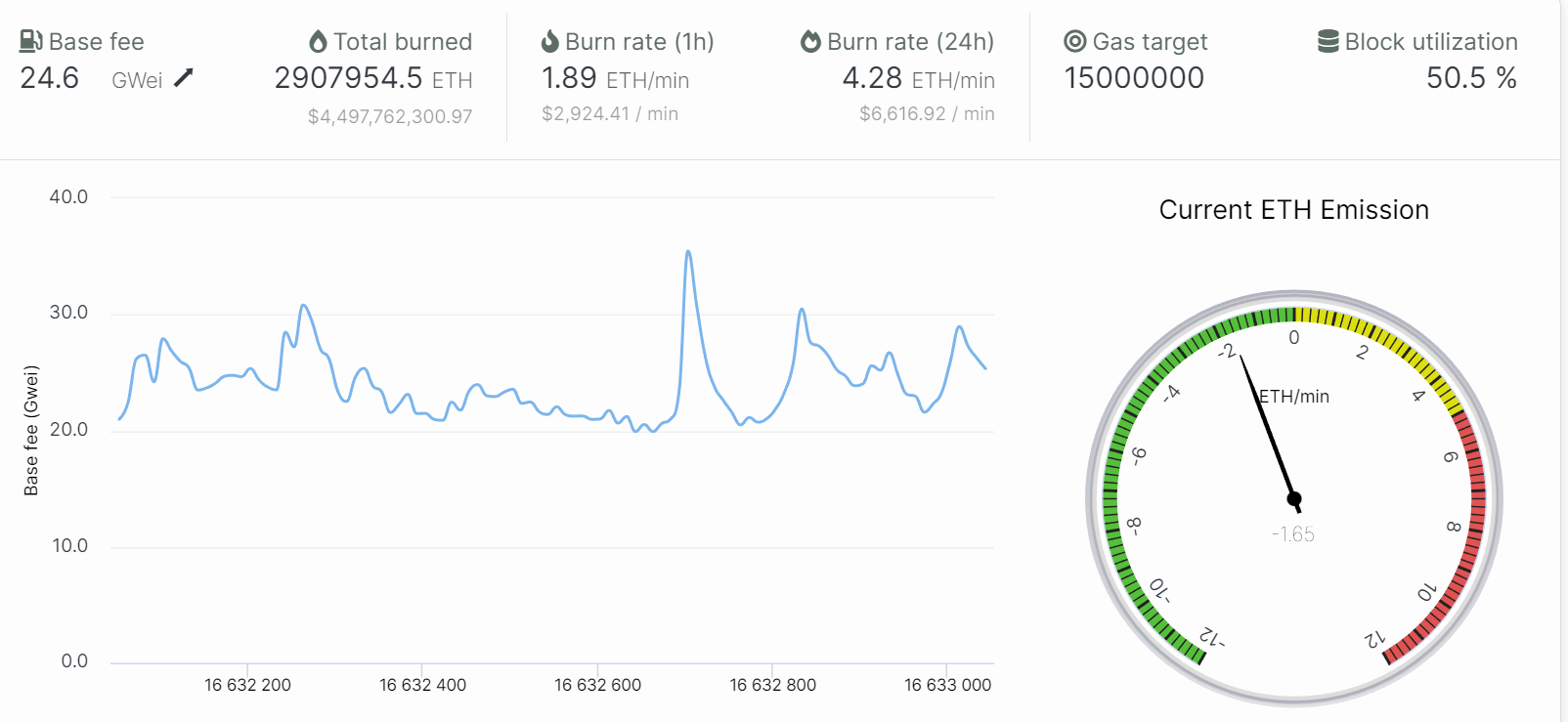

In addition to a steady decline in the supply of ETH on exchanges, the overall ETH market supply has also seen a decline since it turned deflationary after the London update. The deflationary model comes from a fee-burn mechanism introduced via the Ethereum Improvement Proposal (EIP)-1559.

A total of 2.9 million ETH has been burned since the London update in August 2021, whose current value is estimated at $4.5 billion.