As 2024 draws to a close, bitcoin investors are looking forward to the final quarter of the year, traditionally known for positive price action. As many speculate that a bullish rally may be on the horizon, let's look at historical data, analyze trends, and weigh the possibilities of what btc price action could look like by the end of this year.

Historical performance of bitcoin in the fourth quarter

Looking at the last decade in the bitcoin-portfolio/monthly-returns-heatmap/”>Monthly profitability heat mapThe fourth quarter has frequently generated impressive gains for bitcoin. Data shows that btc usually finishes the year strongly, as evidenced by the three consecutive green months in 2023. Not every year follows this trend, however, 2021 and 2022 were less favorable, and bitcoin ended the year on a brighter note. bassist. However, years like 2020 and 2015 through 2017 saw huge price increases, highlighting the potential for a bullish finish in the fourth quarter.

Analysis of possible results of the fourth quarter of 2024 based on historical data

To better understand the possible results for Q4 2024, we can compare the previous Q4 performance with the current price action. This can give us an idea of how bitcoin could behave if historical patterns continue. The range of potential outcomes is wide, from significant gains to minor losses, or even sideways price movements. The projection lines are coded in rainbow colors, from 2023 in red to 2015 in a light purple hue.

For example, in 2017 (purple line), bitcoin saw a significant rise, suggesting that in an optimistic scenario, bitcoin could reach prices as high as $240,000 by the end of 2024.

However, more conservative estimates are also possible. In a more moderate fourth quarter, bitcoin could range between $93,000 and $110,000, while in a bearish scenario, prices could fall as low as $34,000, as seen in 2018 (blue line).

The average result based on this data seems to be around the price of $85,000. Although this is based on the year-end price of these projections, years like 2021 (yellow line) resulted in a considerably higher price before notable pullbacks at the end of the year.

Is the average result a possibility?

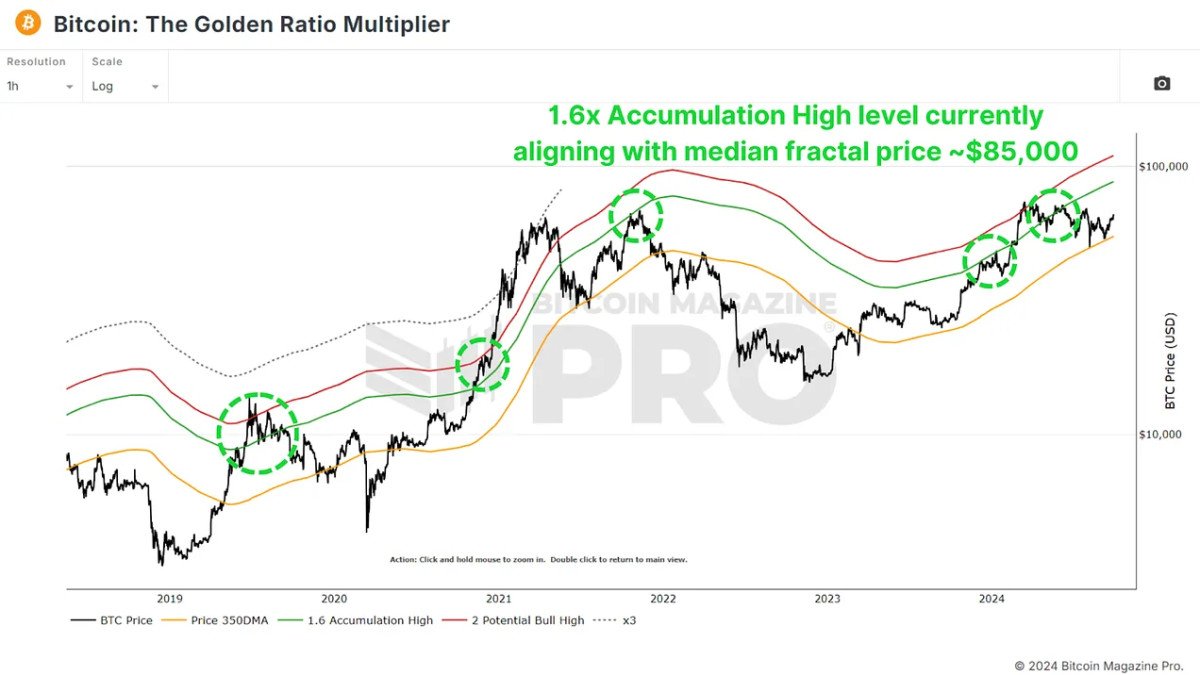

While $85,000 in about three months may seem optimistic, we only have to look back to February of this year to see a single month where btc saw a 43.63% increase. We can also look at metrics like The Golden Ratio Multiplier They are showing confluence around this level as a potential target with their maximum accumulation level of 1.6x.

Is it possible to get $240,000?

Whether bitcoin can reach such high values will depend on several factors. A surge in demand coupled with limited supply could push bitcoin to new all-time highs. Additionally, developments such as bitcoin ETFs, institutional investments, or major geopolitical developments could further drive demand. We are also seeing a similar pattern in this cycle as we have seen in the previous two, with a bitcoin-portfolio/cycle-capital-flows/”>First wave of large-scale capital inflows into the market. before a period of reflection; potentially setting up a second rally in the near future.

This is probably too ambitious, bitcoin's market capitalization has grown enormously since 2017 and we would need tens of billions of money in the market. But bitcoin is bitcoin, and nothing is off the table in this space!

Conclusion

Ultimately, while historical data suggests optimism for the fourth quarter, predicting the future of bitcoin is always speculative. A third of all these projections resulted in sideways price action, and one predicted a full-scale decline. As always, it is important for investors to remain impartial and react to, rather than predict, the data and bitcoin price action.

For a more in-depth look at this topic, watch our recent YouTube video here:

bitcoin Q4: a positive end to 2024?