The Ether (ETH) price declined 10.2% between January 8 and 10, and has been trading in a range near the $1,500 level ever since. More importantly, on a broader time frame, Ether is down 52.5% in twelve months, which partly explains why derivatives metrics were somewhat neutral after Ether’s failed attempt to break above $1,700 on the 8th. February.

Currently, the biggest concerns for investors are the US Securities and Exchange Commission (SEC) lawsuits and enforcement actions against cryptocurrency companies, which included the failure of Kraken from its program as a service and PayPal. reportedly pausing its stablecoin project due to regulatory concerns.

An SEC crackdown on cryptocurrency staking is expected to have unintended consequences for decentralized finance (DeFi), according to Jacob Blish, head of business development at Lido DAO. Blish joined a growing number of people in the cryptocurrency industry calling for transparency in the regulation of the cryptocurrency sector.

On the bright side, the Ethereum developers announced the pre-release of the Shanghai update on the Zhejiang testnet. According to a blog post on February 10, the transition is required to allow withdrawals from validator stake positions. The Zhejiang testnet is the first of three testnets simulating Shanghai, and is expected to go live in March 2023, though no specific date has been released.

Let’s look at Ether derivatives data to understand if the $1,700 price rejection has affected crypto investor sentiment.

ETH futures show slowing demand for leveraged longs

Retail traders often avoid quarterly futures because of the difference in prices from the spot markets. Professional traders prefer these instruments because they avoid the fluctuation of funding rates in a perpetual futures contract.

The three-month futures annualized premium should trade between 4% and 8% in healthy markets to cover costs and associated risks. However, when futures are trading at a discount compared to regular spot markets, it shows a lack of confidence from leveraged buyers, which is a bearish indicator.

The chart above shows that derivatives traders are more bearish because the Ether futures premium moved below the 4% threshold. Consequently, bears can celebrate that the indicator did not show a modest premium even as ETH tested $1,700 on Feb. 8.

The absence of demand for leveraged longs does not necessarily translate into an expectation of adverse price action. Therefore, traders should analyze the Ether options markets to understand how whales and market makers are pricing the probabilities of future price movements.

A key options risk metric flirted with bearish sentiment

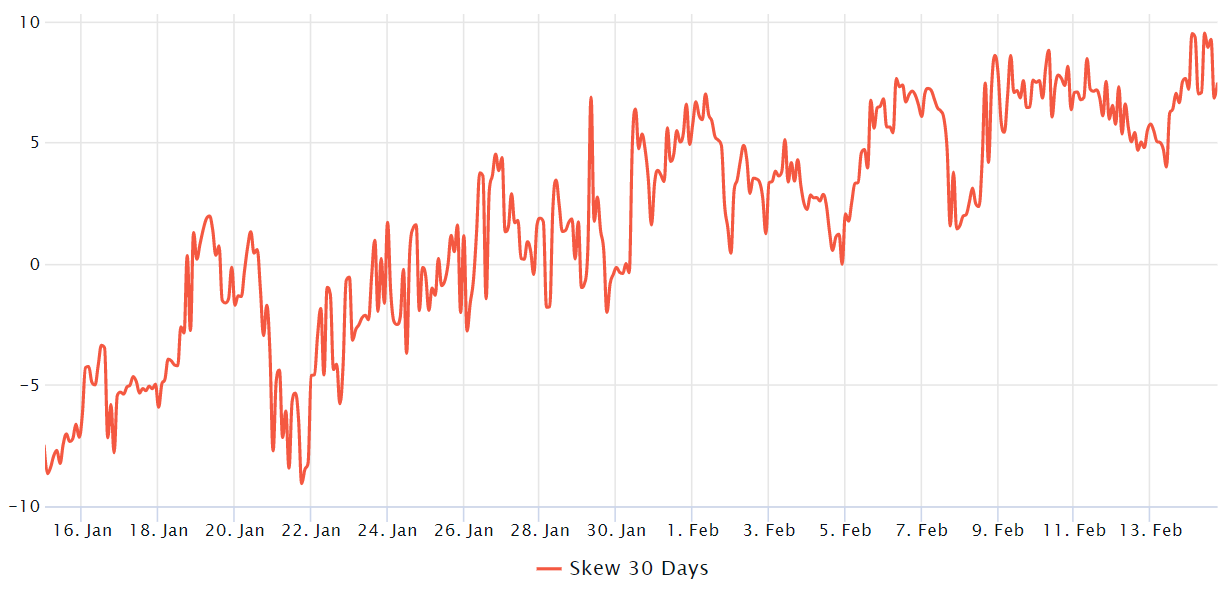

The 25% delta bias is a telltale sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, option investors give higher odds of a price dump, driving the bias indicator to rise above 10%. On the other hand, bull markets tend to drive the bias metric below -10%, which means that bear put options are less in demand.

Related: US Lawmakers and Experts Debate the SEC’s Role in Crypto Regulation

The delta bias flirted with the bearish 10% level on Feb 14, indicating stress from professional traders. That’s a stark contrast from late January, when the 25% bias ratio hovered around 2%, indicating similar upside and downside risks.

Ultimately, both the options and futures markets point to professional traders moving into neutral to bearish sentiment, showing moderate discomfort after the $1,700 price rejection.

Consequently, the odds favor Ether bears because the hostile regulatory environment tends to amplify the adverse effects of FUD, whether or not it directly affects adoption and use cases of the Ethereum network.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making a decision.