While the stablecoin market has seen significant redemptions in the last three months, supply of tether, the largest stablecoin by market capitalization, has risen by $2.46 billion since mid-November 2022. Tether is the only one of top five stablecoins by market valuation. which has seen an increase in supply in the last three months.

Tether Supply Rises While Competing Stablecoins See Declines

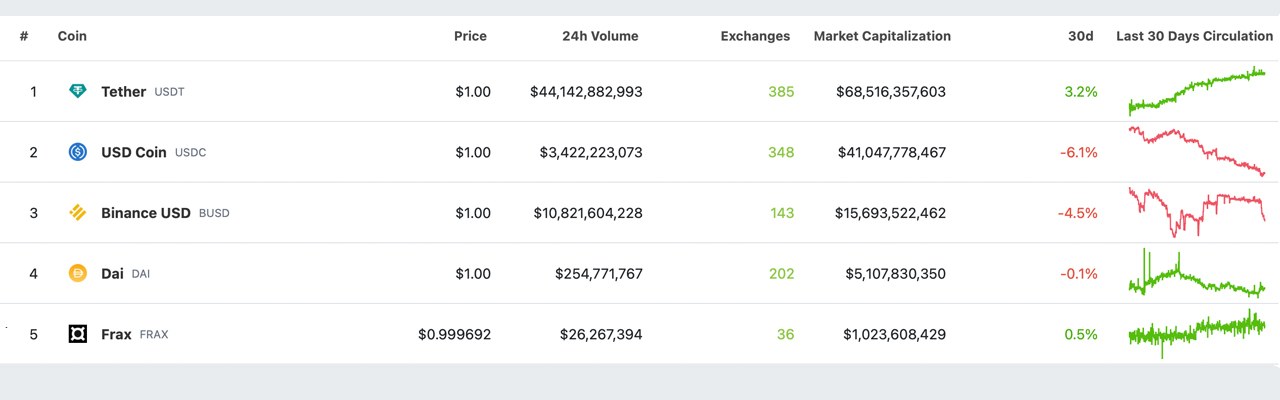

A lot has changed in the last three months after the FTX collapse and its aftermath. The stablecoin economy has seen significant redemptions and 30 days Statistics on February 14, 2023, show that three of the top five stablecoins have seen their market capitalizations decline. The affected stablecoins are usd coin (USDC), binance usd (BUSD) and DAI. While BUSD saw significant redemptions after the announcement that Paxos would no longer mint the stablecoin, USDC saw the biggest drop, losing 6.2% in the past month. BUSD decreased 4.5% in the last 30 days, and DAI had a slight decrease of 0.1%.

tether (USDT), on the contrary, has experienced an increase in supply of 3.2% in the last 30 days. In fact, in the last three months, USDTThe supply of has grown by 3.74%. Together, the top five stablecoins make up the majority of the stablecoin economy and the significantly large trade volume of dollar-pegged tokens. On November 17, 2022, USDTThe circulating supply was around 65.94 billion, and after an increase of 3.74%, today amounts to 68,410 million. While USDTSupply of has grown in the last three months, the bottom four stablecoins have seen no growth at all, and in fact all have seen declines.

For example, the circulating supply of USD coins on November 17, 2022 was around 44.40 billion, but since then it has been reduced to the current 40.980 million. BUSD had a circulating supply of 23.03 billion on November 17, 2022, and is now approximately 15.69 billion, a decrease of 31.87%. Makerdao’s DAI token has a circulating supply of 5.09 billion today, compared to 5.44 billion three months ago, a decrease of 6.43%. The fifth largest stablecoin by market valuation, FRAX, had a circulating supply of 1.177 billion on November 17, 2022, and now has 1.024 million as of February 14, 2023, a decrease of 12.99%.

In the last five years, stablecoins have expanded tremendously, and some dollar-pegged tokens have not lasted. The stability of the reserve and the ability of the issuer to hold it are crucial factors in the success of a stablecoin. The Terra UST crash of 2022 underscored this importance, and last year demonstrated that stablecoin economics are greatly affected by external factors such as economic conditions, market volatility, and regulatory developments.

What do you think about Tether’s recent supply growth compared to the rest of the stablecoin market? Share your thoughts in the comments section below.

image credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service or company. bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.