Bitcoin (BTC) saw continued rejection below $22,000 through Feb. 14 as markets braced for the impact of macroeconomic data.

Bitcoin vs. CPI: “Expect volatility”

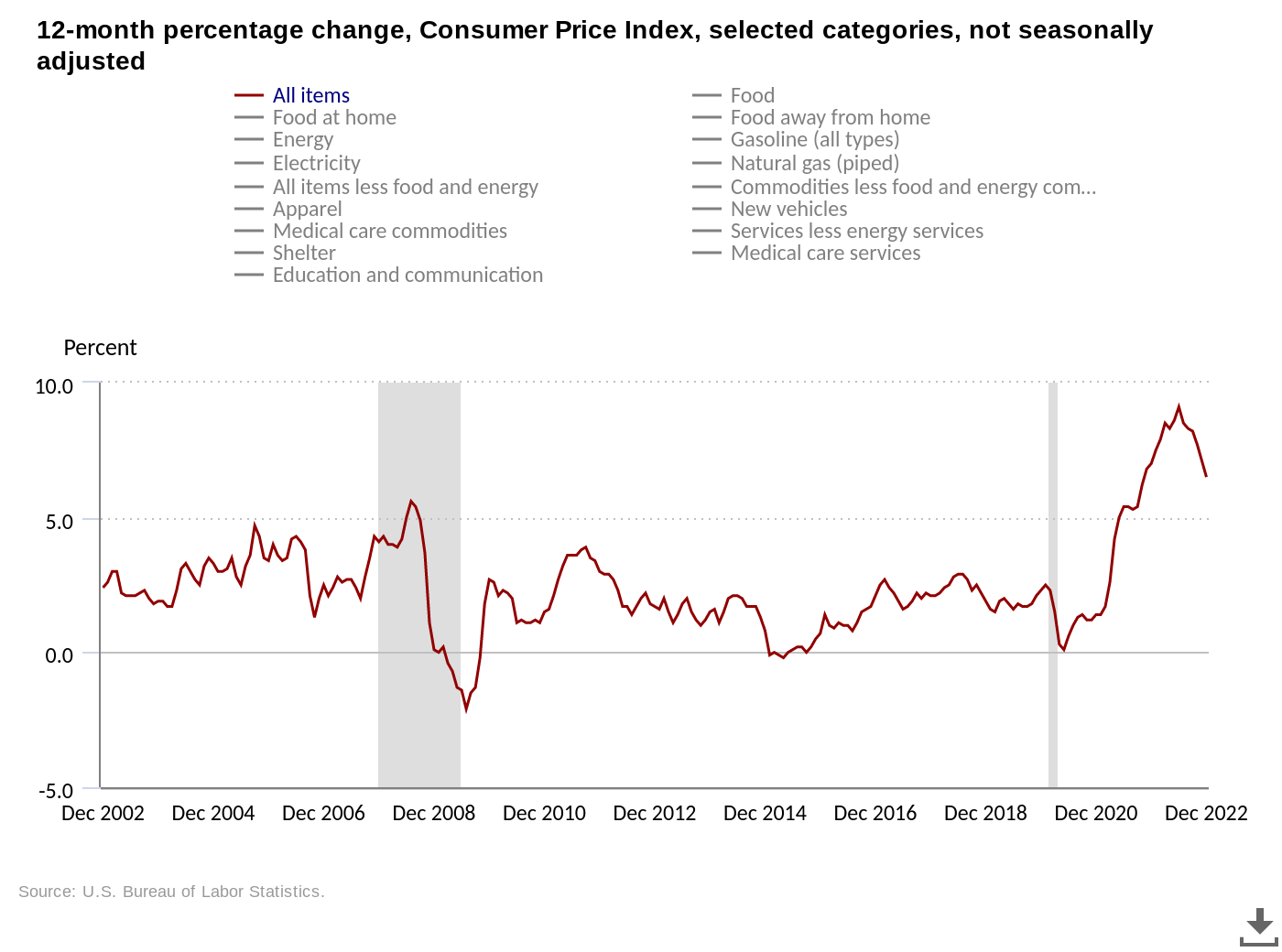

Data from Cointelegraph Markets Pro and TradingView showed that BTC/USD failed to expand beyond $21,800 ahead of the United States Consumer Price Index (CPI) print for January.

Already dubbed the “most important” CPI release, the data, set to be released at 8:30 am ET, is a classic volatility catalyst for risk assets.

Therefore, crypto market participants were expecting a busy trading day, with $19,000 and $25,000 on the table as potential targets, depending on how far off the estimates are.

“We’ll probably see that $24-25k Bitcoin pump if tomorrow morning’s CPI number shows further disinflation in the positive direction,” Venturefounder, a contributor to on-chain analytics platform CryptoQuant, wrote in part from a Twitter update.

“Conversely, a negative surprise would set up a perfect retest at $19-20k BTC on a very important day. Expect volatility.”

CPI yoy was expected to come in at 6.2% vs. 6.4% the previous month, with the mom reading due to a rise from 0.1% to 0.5%.

“Relatively high expectations if you combine this with the previous trend,” Michaël van de Poppe, Cointelegraph contributor, founder and CEO of trading firm Eight, argument up to date.

Van de Poppe was already bet in the “final leg” of Bitcoin’s current pullback, with $20,500 a key level for bulls to hold on to.

IPC “crucial” to determine crypto losses

in his last market updateMeanwhile, trading firm QCP Capital pointed to factors beyond the data as a cause for concern for crypto investors.

Related: Bitcoin Flirts With Supply Liquidity As BTC Price Approaches New 3-Week Lows

He warned that ongoing legal proceedings against blockchain company Paxos and Binance’s BUSD stablecoin could be the tip of the iceberg when it comes to US regulatory policy.

“With the regulatory hammer still being stacked against the industry (possibly until the 2024 election), the cryptocurrency market cap advantage looks even more muted from that perspective now,” he wrote.

“Therefore, today’s CPI printout is vitally important in deciding the extent of cryptocurrency downsides.”

QCP went on to say that there was a mismatch between expectations and reality when it comes to the Federal Reserve cutting interest rates even though inflation is theoretically declining.

“In the rates market, we are now quoting a 5.2% terminal rate, followed by a 30bp cut for December 23, a monumental increase from 4.9% terminal and the 50bp cut just two weeks”, highlights the report.

“Risk assets have clearly not adjusted to this rise in rate expectations, and we expect today’s print to align all markets, whether it’s a stock sell-off (in higher-than-expected numbers) or a rate hike (in a lower number than expected).”

The Fed is not due to call a rate change meeting until the third week of March, with another CPI release before then.

The views, thoughts and opinions expressed here are those of the authors alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.