Image source: Getty Images

When we look back in a few years, I think it will be a good time to invest in small-cap growth stocks. Many of these smaller UK companies are trading at low valuations, despite having tons of potential.

Looking ahead, investor confidence could get a boost as inflation and interest rates fall. So I think now is an opportune time to consider buying UK small cap stocks.

Analysts are optimistic about this.

One that caught my attention recently is Kooth (LSE: KOO). It is a digital mental health provider with a market capitalization of just £114m.

Since going public in 2020, the stock has risen 36%. However, it is down 19% from the peak reached three years ago.

On September 17, Canaccord Genuity reaffirmed its “buy” rating on the stock and issued a price target of 580 pence. On the same day, Berenberg Bank also reissued its “buy” rating, with a target of 590p.

If this is realized, they would represent gains of up to 81% from the current price of 326 pence. Naturally, this is not guaranteed to happen. But when there's a discrepancy that big, my ears perk up.

What exactly does the company do?

Kooth works with the NHS, local authorities, charities and businesses to deliver digital mental health services to children and young people. It is one of the largest and most trusted suppliers in the UK.

However, last year, Kooth won a contract with the California Department of Health Care Services worth at least $188 million. It will offer digital mental health care to youth ages 13 to 25 in all 58 counties in the state through mid-2027.

In the first half, the company's revenue increased 179% year-on-year to £32.5m. This was driven by expansion in the US, which now accounts for approximately 70% of total annual recurring revenue.

Gross margin expanded to 82.4%, up from 68.8%, while adjusted EBITDA was £7.8m. Profit after tax was £3.9m, up from £0.5m.

While Kooth is growing well, it doesn't have a long track record of profitability. This increases the risk for the investment case.

Mental health epidemic

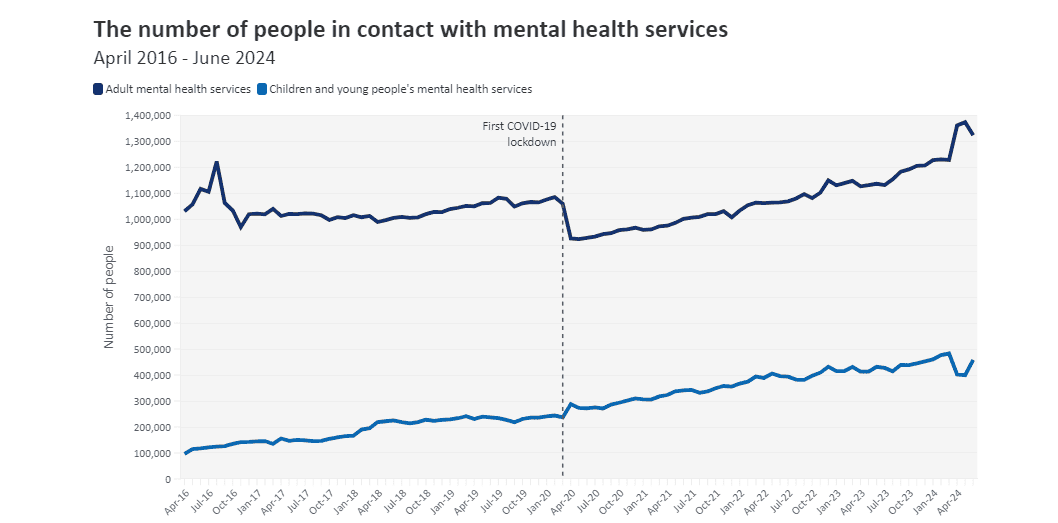

Going back, this (unfortunately) seems like a large and growing market. Social media is causing increasing levels of anxiety and depression among young people.

According to the British Medical Association, the rate of people aged 17 to 19 likely to experience a mental health disorder increased by approximately 150% between 2017 and 2022.

Surprisingly, Kooth says that 22% of high school students in the United States have seriously considered suicide in the past year.

These issues are not likely to go away in the digital age, which should result in growing demand for the company's online mental health platform.

my decision

There are several things I like here from an investment perspective:

- Growing income, most of it recurring

- Strong purpose at its core (strong ESG)

- Strong balance sheet, with net cash of £14.9 million

- Likely expansion to other US states (also won a contract in Pennsylvania)

- Enter the $30 billion Medicaid market

The company is just becoming profitable, so the P/E ratio is of little use. But the stock trades at about 1.7 times forecast sales. In my opinion, that's very cheap for a growing business.

I will consider buying Kooth stock with extra money in October.