Image source: Getty Images

Despite being up 7.9% year-to-date, I still see plenty of bargains on the market. FTSE 100 IndexFor years, UK stocks have looked very undervalued compared to their US counterparts. I think investors are finally waking up to this.

But while share prices for several interest groups have risen this year, there are still great buying opportunities for savvy investors.

Given the above, could these two stocks be the best value stocks in the index? I think there are arguments in favour. If I had the cash, I would buy both for my portfolio today.

JD Sportswear

The first one is JD Sportswear (LSE: JD.). Although its shares have fallen by 2.1% so far this year, they have been gaining momentum recently. Over the past six months, its share price has risen by 42.1%.

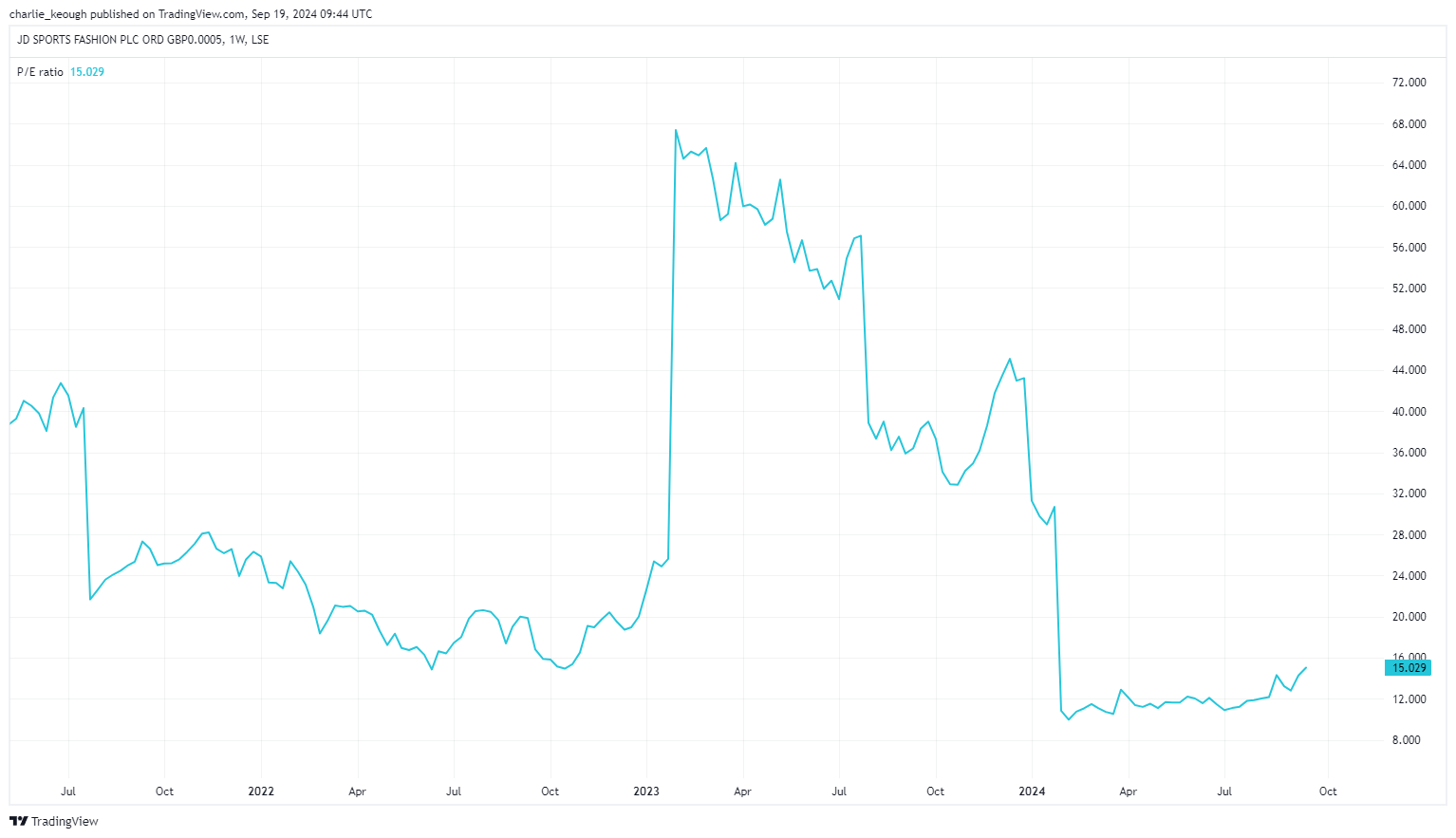

With that increase, as the chart below shows, the stock now trades at a price-to-earnings (P/E) ratio of just over 15. That's slightly above the FTSE 100 average of 11. However, it's significantly below JD's historical average of 23.

JD has struggled mightily over the past two years due to a spending slowdown. As a result, it issued a profit warning in early 2024 that sent investors scrambling to dump its shares. In the coming months, this will remain a threat as the cost of living crisis continues and consumers continue to shelter in place.

But as a long-term investment, I see a lot of good things in JD. We are starting to see interest rate cuts, which should hopefully lead to an increase in spending.

The company also has ambitious expansion plans for the coming years. As part of this, it opened 216 new stores last year. It has also focused on global expansion. That is why it recently acquired the American brand Hibbett. I think the times ahead could be exciting for the company.

Central

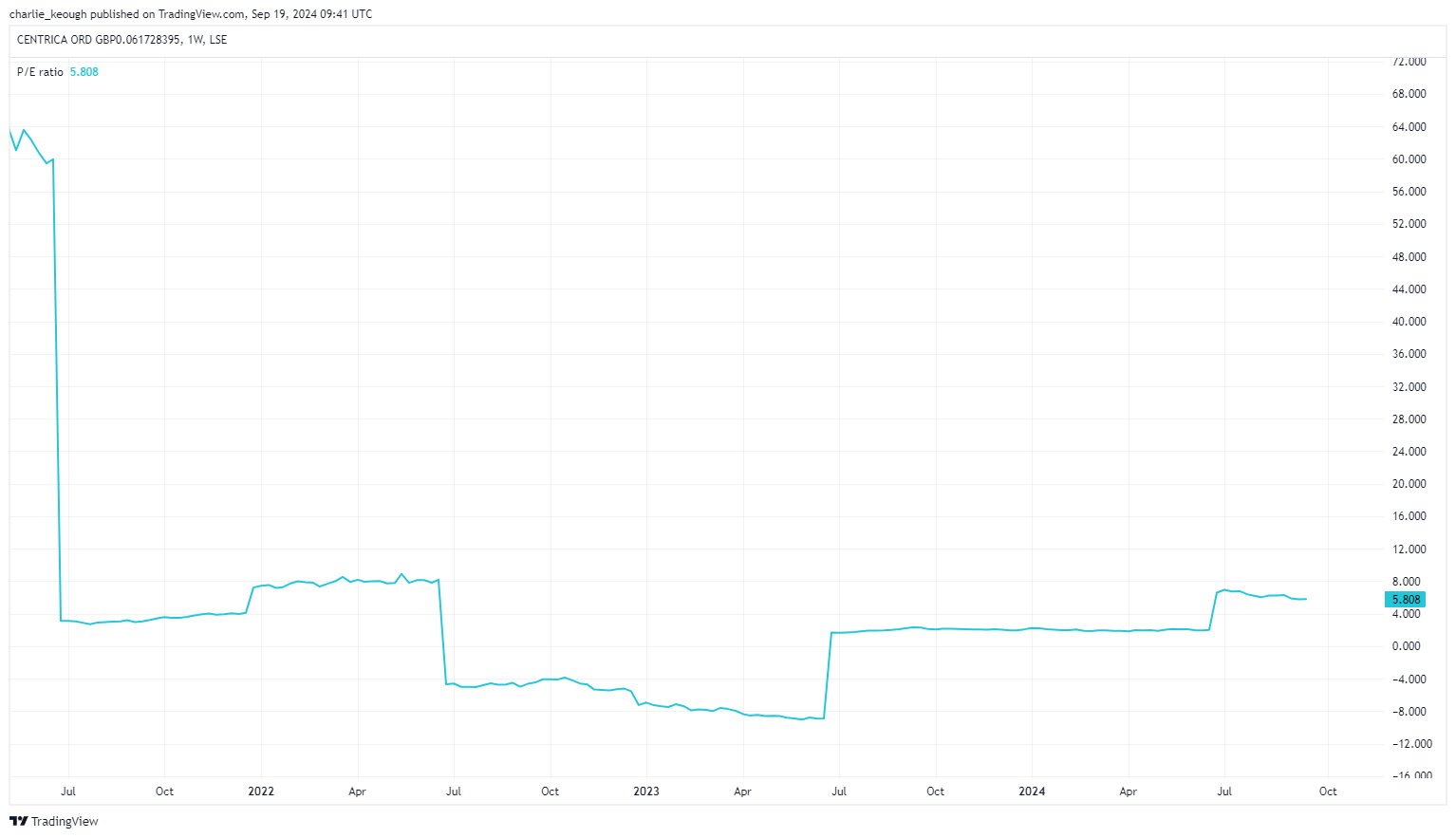

Actions of an energy power Central (LSE:CNA) also looks set for a massive value. With a 16.1% drop in 2024, as the chart below shows, its closing P/E is 5.6. It also has a forward P/E of 7.1.

The company's shares had been on a tear through the end of 2023 due to rising energy prices. However, this year has been a tough reality check for the company. In its half-year results, it announced that adjusted operating profit fell to just over £1 billion. That's half of what it was the year before.

This highlights a risk of stocks: they are cyclical. When energy prices rise, as they have in recent years, the stock can soar. Similarly, Centrica's stock can plummet when energy prices fall.

But as a long-term investor, I'm happy with some ups and downs if I see long-term potential. With Centrica, that's true. This is especially true with its cheap valuation.

Despite a weaker performance this year, the company remains on track to meet its full-year expectations. In fact, it is on track to meet its medium-term earnings target two years ahead of schedule.

In addition, the stock offers a 3.5% dividend yield and recently announced a £200m share buyback plan.