This article is also available in Spanish.

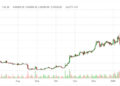

The recent market crash for bitcoin and other cryptocurrencies has caused prices to plummet into the red across the board. As a result, sentiment among cryptocurrency investors has plummeted rapidly and this has caused the fear and greed index to plunge into extreme fear territory. This suggests that investors are less likely to put money into the market, but it could also bring good news for the market.

Fear and Greed Index at the Extreme

The bitcoin Fear and Greed Index is one of the best indicators to know how investors feel about the market at any given time. This index uses a scale of 1 to 100, representing feelings ranging from fear, extreme fear, neutrality, greed, and extreme greed. Each of these can show how investors are feeling and could be an indicator of where the bitcoin price could be headed from now on.

Related reading

Typically, when the Fear & Greed Index is at either extreme, it could mean that the price is about to swing in the opposite direction. For example, if the bitcoin Fear & Greed Index is at one extreme, it could suggest that the price is about to fall, and vice versa.

This trend would be positive for the price of bitcoin at the moment, as the fear and greed index has… crypto/fear-and-greed-index/” rel=”nofollow”>fallen By Friday, the fear and greed index had fallen to 22, putting it firmly in extreme fear territory.

Considering that bitcoin's price tends to rally when the index is in the red, it could mean that the price is bottoming out. An example of this is when the bitcoin Fear and Greed Index dropped to 20 in August, before the cryptocurrency market experienced a quick rally. If that happens here, bitcoin's price could be on the verge of a recovery.

bitcoin is unlikely to recover in September

While the Fear and Greed Index being in the extreme fear territory could indicate that it has bottomed out, the rally may not materialize for a while. This is because the month of September has historically been very bearish and expectations are that this month will be no different.

Related reading

Veteran analyst Benjamin Cowen outlined it in a post on x (formerly twitter), revealing that this month is already in line with previous Septembers. So far, the price of bitcoin has already dropped by 8.16%, and “if btc closes the month at this price, it would be a pretty typical September,” the analyst explains.

<blockquote class="twitter-tweet”>

The average performance of twitter.com/hashtag/btc?src=hash&ref_src=twsrc%5Etfw” rel=”nofollow”>#btc In September it is -6.3%

So far this month, btc's performance is already -8.16%.

The only time in the last 5 years that the September monthly performance was worse than this was in 2019 (-13.91%).

If btc closes the month at this price, it would be a pretty typical September. image.twitter.com/bZ9cRIl9OU

—Benjamin Cowen (@intocryptoverse) twitter.com/intocryptoverse/status/1832078594224398802?ref_src=twsrc%5Etfw” rel=”nofollow”>September 6, 2024

However, October is usually a bullish month, so if this trend continues, September is likely to end in the red. But when October comes, prices are expected to rise again.

Featured image created with Dall.E, chart from Tradingview.com

<script async src="//platform.twitter.com/widgets.js” charset=”utf-8″>