Image source: Getty Images

The omens are not good for investors looking to make big profits in September. Data shows that the ninth month of the year is easily the worst for UK share prices.

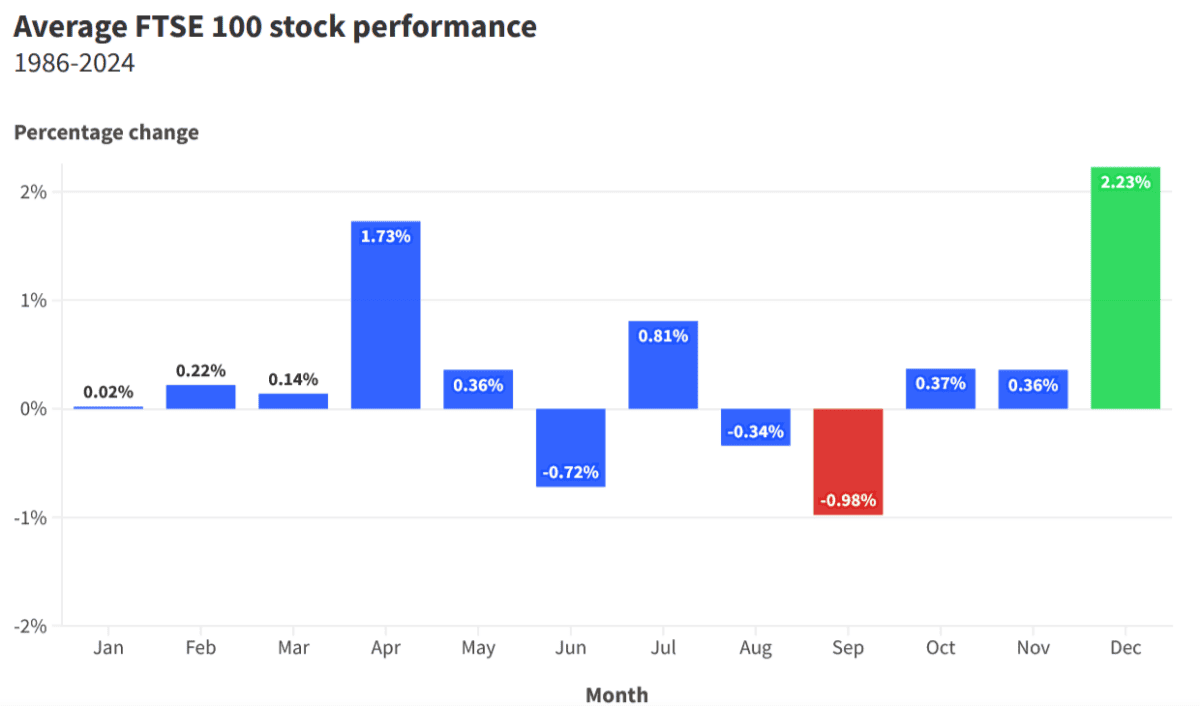

According to Finder.com, the FTSE 100 Index has fallen, on average, 1% each September since the mid-1980s.

To be fair, other major international indices have also historically recorded their worst results in September. Euro Stoxx 50 Index has fallen by an average of 2.13%, while the S&P 500 Index and Nikkei 225 have reversed 0.88% and 0.83%, respectively.

So what should I do now?

What's happening?

First, it is worth considering why indices such as the Footsie fall during the first month of autumn.

Price comparison expert Finder has a few theories, including:

- Institutional factors, such as investors selling near the end of the third quarter.

- Funds abandon less successful investments before the end of the quarter

- Investors returning from summer vacations cashing in and offsetting gains with losses before the end of the year

- Negative market expectations for September boost sales as part of a “self-fulfilling prophecy”

What's next?

So the “September effect” is likely a market blip rather than a solid reason to sell and run.

As someone who invests for the long term (I aim to hold the stocks I buy for a minimum of five years), I am not worried about the prospect of another bad September. I am confident that the stocks I buy will steadily increase in value over an extended period.

In fact, this month I will be doing the opposite of many investors: I will be looking for oversold bargains to add to my portfolio. This way, I will have the opportunity to make bigger capital gains by buying at even lower prices than I would otherwise expect thanks to September's market anomaly.

A top quality purchase

One stock I'm already looking at today is Hochschild Mining (LSE: HOC).

The precious metals miner has had a poor start to September and now looks like it might be too cheap to pass up. It trades on a forward price-to-earnings (P/E) ratio of 8.2 times.

However, Hochschild's decline is not primarily due to this month's historic cooling. It is more likely to reflect a drop in gold and silver prices as the US dollar has appreciated. A rising dollar makes it less profitable to buy and hold dollar-denominated assets.

Mining companies are naturally vulnerable to volatility in commodity markets. However, the good news for gold producers is that the yellow metal could recover strongly in the coming weeks and months.

Prices hit new record highs above $2,500 an ounce last month, driven by concerns about economic growth, conflicts in Europe and the Middle East and expectations of higher inflation as central banks cut rates.

Therefore, I would expect Hochschild shares to also recover as metal prices improve. However, I would not buy the miner simply to cash in on this. I think it could be an excellent stock to hold for the long term to manage risk in my portfolio.

And at current prices, it could be a very profitable way to do so.