U.Ozel.Images/E+ via Getty Images

Although other companies are on the cusp of gaining approval for GLP-1 receptor agonist weight-loss drugs, they are unlikely to dent Eli Lilly's dominance (New York Stock Exchange:LLY) and Novo Nordisk (NVO), who control the market now.

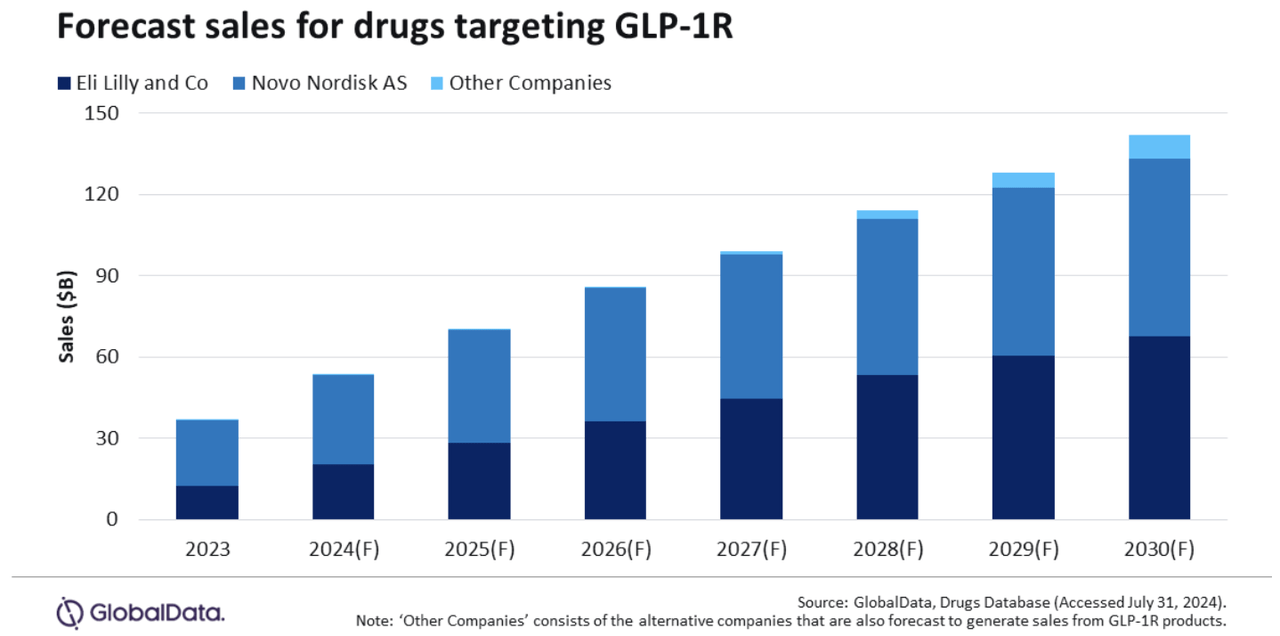

In 2023, the two companies accounted for 99% of all GLP-1R agonist sales. By 2030, that figure is only projected to decline to 94% despite the likely entry of similar drugs, according to GlobalData.

The category generated $37.2 billion in sales in 2023, the data and analytics firm said.

Novo markets Ozempic and Wegovy (both semaglutide) for type 2 diabetes and weight loss, respectively, while Lilly's lead GLP-1Rs are Mounjaro and Zepbound (both tirzepatide) for diabetes and weight loss, respectively.

According to GlobalData's forecasts, another 14 companies will market GLP-1R by 2030. However, these companies are only expected to generate $8.8 billion in revenue, a figure “15 times lower than the combined valuation of the two leading companies,” says Jasper Morley, pharmaceutical analyst at GlobalData.

GlobalData's assessment mirrors one given in June by JP Morgan's Holly Morris and Cantor Fitzgerald's Louise Chen, who spoke at the Seeking Alpha Investment Summit about the weight-loss drug market. Morris said the two companies' size and early arrivals to the market have likely cemented their hold on the space, while Chen noted that differentiation will be key for any new entrants to the market.

Lilly (LLY) and Novo (NVO) also have their own advanced GLP-1 receptor drugs in development. Lilly has the oral tablet orforglipron and the GIP/GLP-1/glucagon receptor agonist retatrutide in Phase 3, as well as three other anti-obesity drugs in Phase 2. Novo has CagriSema, a combination of semaglutide and the amylin analog cagrilintide, as well as a daily oral version of semaglutide. The Danish company also has three other weight-loss drugs in Phase 2.

One of the most anticipated new obesity drugs that could come to market that is not from Lilly or Novo is Amgen's (AMGN) MariTide, which is a GLP-1 receptor and GIPR receptor agonist. It is currently in Phase 2 for diabetes and weight loss.

However, that candidate is expected to generate only $3 billion in sales by 2030, according to Global data.

Other candidates to watch include Viking Therapeutics' (VKTX) VK2735, which is in Phase 2 and was recently reviewed positively by Seeking Alpha analyst Stephen Ayers. An oral version of the candidate is in Phase 1. Roche (OTCQX:RHHBY) has three candidates in Phase 1 development: a GLP-1 receptor agonist, a dual GLP-1/GIP receptor agonist (same mechanism of action as Mounjaro and Zepbound), and a latent antimyostatin.

Additionally, Zealand Pharma (OTCPK:ZLDPF) and Boehringer Ingelheim are developing survodutide, while Altimmune (ALT) is developing pemvidutide.